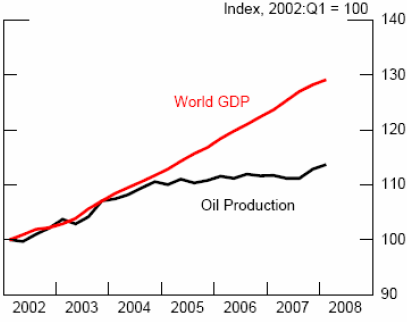

369. OIL FLAT, GROWTH CONTINUES

Great graphic over at the Oil Drum today:

It comes from the new CFTC report which finally and conclusively proves that futures market participants have no effect whatsoever on prices in the futures market.

The folks at TOD had their own nefarious reasons for posting this, but what caught my eye is how global growth just keeps on trucking, even without growth in oil. Which is a little odd considering that no less a figure than Colin Campbell, the Pope of Peak Oil, has called oil "the principal driver of economic growth"Source.

by JD

27 Comments:

As usual, please use the Name/URL option (you don't have to register, just enter a screen-name) or sign your anonymous post at the bottom. The conversation is better without multiple anons.

Thank you,

JD

Yeah, you noticed too, JD?

But there's a catch. Can you spot the big con, I mean big mistake (of course it is not a con!) in it?

Because graphs can tell you anything you want. The graphs are aligned in a certain way that tell us that they were "jointed" until year 2005, and then they dissociate themselves.

What is not revealed is how they were aligned like this in the first place. Because the y axis are obviously not equivalent, you can make them aligned any way you want them. If you wanted to, you could have them aligned since 2005, or you could have them completely unaligned.

It's a sham, and so blatant, I got so disgusted that couldn't even login to that site to completely denounce that shit.

Of course, your reading of the thing is quite cynical and ironical. Even if they were somehow "true" on their graphic fabrication, then one could only conclude what you have concluded. Of course, for those morons, it is only another argument on how we are above "carrying capacity" once again.

It's a sad sad situation, to see all those sheep gathering at the feast for those expert wolfs of misinformation, doom porn and self-deceit.

I mean, who tha fuck is this CTFC thing? Another ASPO gathering of dipshits?

Sorry. I'm in a bad mood today.

PS

What these morons also fail to understand is that they keep banging new moronic rationales to prove their work case again and again, without even noticing that their new "evidences" are always quite "successful" at the moment they are regurgitated, but at the cost of debunking previous "proofs" of their pet doom theories.

If one had the trouble to make a coherent gathering of the statements and theories of those types, one could only conclude that the authors are just wild guessing, the alternative being that they are full of it.

But that was your whole point in this post.

Barba Rija: in that graph, both gross world product and world oil production start at 100 (as in 100%) in 2001. So there is the principle behind their alignment: the state of affairs in 2001 is taken as the reference point.

Possibly coal and natural gas are filling the gap.

This is the problem I have wiht graphs, any graph...

They can show whatever the author of that graph wants it to show.

Much like the hockey stick with the whole Global Warming scam...

There is no way in hell that demand can go up that much, yet that supply isn't enough to keep the pace.

I have a hard time trusting any graph, any! But that's may just be me.

I don't buy that BS.

I've been in this forum lately, these guys seem to know what they're talking about one has been in the oil biz for 35 years, one holds a PHD in economics, another oil insider, a geologist...These guys all agree on the same thing we've got massive amounts of reserves in the U.S., we're just not really drilling for it. Not to mention in Texas the decline in production has been nearly fully reversed it's set to break production records early next year theough recovery techniques....all the while bioenergys the good ones(not ones that take away from food) are experienceing breakthroughs. Anyways these guys don't see a soft landing, but they sure as hell don't see the end either. There was an article from Bloomberg showing that in Alaska and th sea just beyond probably holds 90 billion in reserves all together...

I am glad I ran into this bunch, they've got their heads on right. Very informitive and intelligent.

But even then they could very well be wrong....time will certainly tell us all.

-Justin

Yes, mitchell, but you see, if they chose any other year, you would have a completely different graph.

Ask any statistician, you can prove your pet theory with nice graphics if you really want to.

And some graphs are glaring in that rethorics. When I see a graph like this spanning only between 2001 and 2008, the obvious question surfaces:

Has the relation between GDP and barrels of oil been a constant throughout the century?

The answer is of course not! It is a moving "constant", which undermines all this bullshit about oil being a cause of GDP. It's fucking ridiculous. And yet, it didn't stop TOD from publishing it as a "I told ya so" graph, ignoring the beautiful irony in it.

This report proves nothing about speculation.

At best, it shows that the there is some correlation between supply and demand but does not conclusively prove anything.

The commitment of traders report is a pretty incomplete assessment of the overall oil market because it does not include data from the ICE and swaps traded across the International Swaps and Derivatives Association, which oh btw, is where about 2/3 of speculative activity occurs anyways.

The takeaway message of the report as I interpret it is that supply and demand and increases in price are correlated, but right now we don't have enough information to conclusively prove causality.

I expect nothing less than the government. Good work guys

One thing that strikes me as VERY interesting about the Kaufman presentation that our friend Stuck in Shizuoka linked to in the last post is how oil use declined in all segments BUT transportation.

This suggests to me that this is really truly a "lifestyle" problem as JD points out. Kaufman also seems to suggest that the shortfalls, while painful, won't be cataclysmic and world-ending. However, as someone who recently gave up his daily driving for NY trains, I've come to realize that solutions are everywhere for reducing oil use in transportation. Perhaps not as easily in places not as well-planned as New York, Tokyo, etc., but still not impossible.

If anything, the fact that Ford, GM, and the rest of the automakers are re-tooling for a "post-SUV" era suggests to me that oil consumption in transportation will be going down down down in the next few years.

Now, will Jevons Paradox, the bugaboo of the PO community, bite us all in the ass? I sincerely doubt it. For one, oil prices ain't goin' down too far from their current levels, short of everyone magically getting RAV-4 EVs tomorrow. I'd say that the current rise in oil costs may not be the doomsday scenario we were presented for years, but may actually be the price signal we all needed to save ourselves from Savinaritude.

And yes, I'm making up words.

Oh, one more thing:

Despite the fact that people are hand-wringing over the fates of GM and Ford, I notice that few people are mentioning how Toyota and Honda are doing.

And they are doing pretty damn well, relatively speaking.

JD-esque succession, anyone?

Lemme see.

1. The oil-producing nations would rather have higher than lower prices. 2. The oil-producing nations have huge mountains of money (sovereign funds) and expert financial advisors, and thousands of financial minion-quislings at their disposal. 3. Oil demand is inelastic in the short-run, meaning if speculators game the price up, demand does not wither for several years. 4. Any financial market can be gamed, and they have been gamed many, many times in the past.

But, oh no! No one ever manipulated the NYMEX! Never! Impossible!

Please. If I ran an oil-producing nation -- and our only real source of income was oil -- of course I would try to game the price higher. It would be a violation of fiduciary duty to my fellow citizens to NOT game the price higher.

So, we can assume oil-producing nations are gaming the price higher, through financial quislings. The gaming worked, as demand is inelastic in the short-run, defined as five years or less.

The gaming worked -- but the game has run its course. Demand is withering, in the medium-term, which we are reaching now. Automakers switching over fleets etc. Now, global demand will likely sink for several years. If prices hold long enough, then the long-term, and much greater elasticity begins to set in, bringing huge, decreases in demand.

What is fascinating is the OPEC-killer lurking in the wings. The death-ray for speculators. The GM Volt.

If such a car works commercially, it is game over for the oil boys and their minion-weenies. Who will need oil then? The world will be able to prosper at 40 mbd or less. Cities will be quieter and have cleaner air.

Tell me the downside in this, because I can't see it.

Benny,

The only downside I can see is having to drive an American car. I just can't do it anymore, man.

I'll wait for the Uber-Prius. :-P

Another game changer is that anyone can buy a 100 mpg gallon scooter for under $1000. and the reduction in costs from such a vehicle are not limited to fuel. you save on Insurance, registration, you can park anywhere, and most repair work is about as difficult as servicing your average lawnmower.

Ari-

Well, give the home team another chance. Maybe this time, they will get it right. Consumer surveys show less and less defects per car.

I don't think there is anything here that is inexplicable.

Growth could "overshoot" oil production if the additional growth is fueled by drawing down stockpiles. We don't see the stockpile numbers on the graph, but EIA data shows US crude stocks are drawing down to the lower end of the "normal" range over the last several months (see the 3rd chart from the top at http://tonto.eia.doe.gov/oog/info/twip/twip.asp).

In my opinion the graph at TOD would have to include total oil resources, which includes stocks, to explain the "overshoot". If you include stocks, oil "production" would be able to continue to rise even as the volume of oil pulled out of the ground on any given day stagnates or falls. The consequence of this is, of course, a drawdown in stocks, but it explains how GDP growth can continue even as oil production levels off.

...global growth just keeps on trucking, even without growth in oil. Which is a little odd considering that no less a figure than Colin Campbell, the Pope of Peak Oil, has called oil "the principal driver of economic growth"

What's odd about global growth with flat oil? One, GDP numbers are easier to fudge than oil production numbers, but that's not the real issue. Everyone agrees that we can be more efficient with the oil we use. So why is it odd that growth occurs with flat oil? I see no contradiction in saying that oil drives growth while observing that production and growth don't always track in a perfectly linear fashion. There's lots of inertia in the system. Either production or growth can peak and dip without the other tracking it linearly.

"So, we can assume oil-producing nations are gaming the price higher, through financial quislings. The gaming worked, as demand is inelastic in the short-run, defined as five years or less."

Wrong your assumptions are based on no facts whatsoever. If countries could manipulate the oil market then why didn't they do it during the 90's? Many sovereign wealth funds such as Dubai and Abu Dahbi invest non-oil industry activities to diversify their economies.

To assume that only oil producing nations are doing the manipulation sounds similar to Americans common held belief to hate every country our media tells us to hate. Few Americans know that many of our companies and governments use to abuse these countries and control their resources. That was okay because we were doing the thugging but if someone else is profiting besides us Americans then they must be thugs and crooks.

PGTL100-

Well, of course, oil producers have always manipulated oil prices upwards whenever they can; see the history of the Texas Railroad Commission. No, I don't hate anybody, even Texans. (Holding despotic governments in contempt is completely different from hating citizens in those countries. I don't hate anybody; I detest corrupt thug-state governments. Sometimes I even detest my own government).

I suspect the answer to your question is that the commodities markets have bloomed in the last 10years, and have arrived at a size that they can be of utility to oil-producing states. Add in huge commodity funds, which did not exist 10 years ago, or even five years ago. The financial heft to there to manipulate.

BTW, I think by buying futures contracts a year out or so, where trading is light, is a great way to manipulate the NYMEX, in addition to simple rigged trades on the spot market. Trading at higher prices in the future creates "contango." Oil sellers see a higher price in the future, and so ask a higher price in the spot market -- otherwise, why should they sell? They know they can sell at a higher price for future delivery. That is why contango for oil can never last long.

BTW, OPEC did manipulate prices in the 1980s, by shutting off supply, and have controlled production ever since. They may have kept prices higher than otherwise all through the 1990s, for I know (or you) by a combination of physical supply controls and financial manipulation. Who knows? The marginal cost of a barrel of Mideast oil is somewhere under $5 a barrel.

But, overall, I come back to my main point: If you run a oil-producing state, you want higher prices. If you can manipulate prices on the NYMEX, you will.

"If such a car works commercially, it is game over for the oil boys and their minion-weenies. Who will need oil then?"

Well, GM, to build much of the Volt. Plastics and petrochemicals are not going away. Oil demand could fall by 40% pretty easily once we stop burning the stuff. We will still need it though.

So Economics 101 is right again. As price goes up, the least cost effective uses are curtailed, and demand drops. World fails to end.

mike s,

I remember reading a discussion between a proto-doomer and Milton Friedman. Friedman essentially said something like, "Substitution, reduced demand for least critical uses, changes in usage."

Doomer responds, "NO SUCH THING AS A SUBSTITUTE FOR ENERGY."

Friedman says, "Oil is not the only source of energy, and can be substituted at some cost."

Doomer, "EROEI! EROEI!"

Friedman, "As long as the return is positive or higher than oil, people will migrate to the new source and work out the kinks somehow."

Doomer, "YOU DON'T UNDERSTAND PHYSICS!"

And so forth. I'm exaggerating for effect, but really... not by much. The typical anti-economist crap was consistently hurled at Friedman, which he basically says "is meaningless to the debate." I'm beginning to realize that, thanks to the higher energy returns on nuclear and wind than people like to admit, he was completely right.

That, and people can substitute big cars with small cars. And small cars with scooters. And scooters with bicycles. Or they can use electrified transit. Etc.

There are changes in how product is provided to consumer as oil peaks. Netflix and DVD rental is an example of how product changes: it provides video movie rentals on DVD, lighter, slimmer disks that take less oil to transport than the big bulky VHS cassettes. DVD's in Netflix's mailers weigh little more than a paper letter.

Barba Rija,

The CFTC is the (U.S.) Commodity Futures Trading Commision and charged with regulating on-exchange commodities futures and options trading. Given that former lobbyists, one from the ISDA, were appointed commissioners, no one should expect its 'analysis' to be particulary unbiased (even if it had the data required, which it does not).

August 2007:

Bart Chilton is the former chief lobbyist for National Farmers Union. Jill Sommers comes to the post from the International Swaps and Derivatives Association (ISDA), where she was the chief lobbyist. Swap dealers aren’t regulated by the CFTC. Why would the President appoint someone from the ISDA? Oh, ya, somebody needs to protect the status quo. The CFTC’s announcement is here. See my article on the influence of swap dealers in futures markets here.

http://commitmentsoftraders.org/?p=23

Problems there are part and parcel of over two decades of the larger financial deregulation... doing away with well thought out and applied rules/regs in favor of a truly nonsensical system captured by and in the pocket of those supposedly being regulated. (to include more than the CFTC).

Yes, oil is flat. So what ? Coal consumption and renewables are fast growing, taking the bulk of today’s energy production growth. China and India are mainly coal based economies and lead the world economic growth. Nothing to wonder about, then, if growth goes on while oil has become flat.

GDP is adjusted to real terms by indexing to CPI/similar indices in other countries. CPI does not include(or distort) many things that have volatile prices, e.g. food/energy.

While the GDP increased in nominal, and real terms, that's just monetary measure, our cost of living couldve gone up.

-Raphael

Dont overlook the nature of what GDP really is.

Just some food for thought, the best indicator of progress I can think of that is more-less documented well would be labour productivity.(obviously energy inputs have significant influence on how productive our labour is.) Cost of living or some quality of life index would also be nice to see.

In spite of rising energy costs, labour productivity is rising both in Canada and the US, and I'm sure the rest of the world as well.

http://www.statcan.ca/Daily/English/071213/d071213b.htm

a large portion of the GDP is of course consumption, and how energy cut into that is probably worth looking into as well, I think it might show something interesting as well, how consumption gets redistributed across various sectors, etc-etc. Unfortunately, I don't know where to get that info.

-Raphael

Raphael,

You can find an informative critique of GDP accounting here:

http://homepage.newschool.edu/~AShaikh/

Scroll down to:

Measuring the Wealth of Nations: The Political Economy of National Accounts

Only the 1'st chapter can be downloaded but I've read the entire book and found it very coherent and extremely well documented.

Problem for the doomer argument is that GDP growth is not equal to resource usage growth. They always assume they are identical though I don't know why.

For example: if the economy shifts to hairdressing then GDP can still grow (for a time) while energy usage is likely to drop.

Likewise, if we start using more efficient means of transport we can spend more for less and GDP grows.

But the biggest failure in my mind for the doomer party line is that they misunderstand that growth is not linear. On average across the entire economy measured in dollars profit it looks that way but this misses all the industries going bust and being replaced as technology advances. For example it probably takes way less energy to make an ipod and download songs than it does to make an 8 track and physically ship thousands of 8 track cassettes.

The doomers need to get their heads around creative destruction.

Your perspective is too limited. 6 years is insufficient to suggest that petroleum isn't the principle driver of the global economy. Inertia, measurment error, and other factors could explain dissonance between two factors over such a short time span (rarely [if ever] are any two covariates correlated 100%).

Post a Comment

<< Home