327. STRONG ARGUMENT FOR A SLOW DECLINE

There is a lot of doomer FUD circulating in the peak oil community about how global oil production will collapse or decline rapidly in the post-peak period. Some of the worst offenders are suggesting that production will decline at rates of 8-12%, or more. These people are fearmongering, plain and simple, and have no sound basis for making these claims. Here are 4 good reasons why global liquids production will decline at a mild rate of less than 2% for 20 years after peak oil.

1) Stuart Staniford of the Oil Drum has shown that Hubbert Theory says Peak is a Slow Squeeze. His analysis shows that (on the average) the world will decline at a rate slower than 2% for 20 years. In fact, it suggests the world will decline slower than the U.S., where liquids production has been declining at an average annual rate of 1.4% for 36 years since its peak in 1970.

2) Colin Campbell currently predicts, in the ASPO Newsletter for Jan. 2008, that liquids production will drop from 87mbd at peak in 2010, to 60mbd 20 years later in 2030. Bust out the calculator, folks. That's an annual decline rate of 1.8%.

3) I myself have pointed out the obvious tendency of large multi-country blocks (like continents etc.) to plateau for decades, including the amazing case of North America, which has been on an undulating plateau of about 14-15mbd for almost 30 years (Source BP Stat. Rev. 2007):

3) I myself have pointed out the obvious tendency of large multi-country blocks (like continents etc.) to plateau for decades, including the amazing case of North America, which has been on an undulating plateau of about 14-15mbd for almost 30 years (Source BP Stat. Rev. 2007):1979 13578kbd

1980 14063

1981 14344

1982 14790

1983 14838

1984 15226

1985 15304

1986 14792

1987 14730

1988 14642

1989 14014

1990 13856

1991 14182

1992 14050

1993 13899

1994 13807

1995 13789

1996 14052

1997 14267

1998 14182

1999 13678

2000 13904

2001 13906

2002 14069

2003 14193

2004 14137

2005 13695

2006 13700

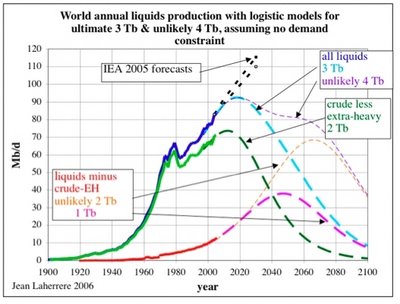

4) Jean Laherrere has also noticed the tendency of large blocks to plateau, and predicts(pdf) the world will plateau for 10 years:

I have access to several technical databases.

Liquids production will significantly decline after a likely bumpy plateau 2010-2020 and likely chaotic oil prices.

30 years from now, production of easy oil will be 35% less than to day but production of all liquids (including from coal and biomass) only 5% less than to day.

Here's his chart:

Eyeballing, the forecast is for 73mbd in 2040, down from a peak of about 92mbd in 2015. That's an annual decline rate of 1%.

To conclude, we've got the four smartest people in peak oil saying that the world liquids decline rate will be 1 to 2% for decades after the peak.

To those doomers who remain unconvinced: I hereby issue a challenge. Post in the comments. Show me the argument that proves Stuart Staniford, Colin Campbell and Jean Laherrere have got it all wrong about peak oil.

by JD

45 Comments:

I used to not believe in Peak Oil, but let me tell you a story:

I get up in the morning and walk out to my driveway to pick up the paper. Yesterday, I went out there and there was no paper.

I was shocked. I went back in my house and thought about all the complex(!) and fragile(!) systems that are required to produce that paper. We need to harvest our decreasing forests to make the paper. We need oil for the inks, and energies to run the presses. And we need oil, lots of oil, for the delivery trucks.

The more I thought about it the more scared I became! These networks are fragile, I mean just look ... NO PAPER!

That is how I know that oil will fall rapidly and we will all starve.

Thank you.

Interesting take on the peak oil theory there, Odograph. All the stats, calculations, arguments and theories presented on this and other sites investigating peak oil are all undone because your daily newspaper doesn’t arrive. I dread to think what mind-frame you would be in if the milk runs out at your local shop/store?

So the worlds oil supply is not going to plummet, yet it is still going to *contract*. It will be interesting to see how the worlds financial markets will fare when they are unable to continue their unbroken streak of infinite growth. Im sure the economies will find new ways to become more efficient and we'll "do more with what we have" in order to stave off a slow decline in energy supplies, but without growing the energy available to the economic system we will never see the growth that all of our financial structures are built on. Would you put your money in a bank that gave you negative interest? Even if its "only" 1%? Perhaps 1% decline wont be so bad after all, although 330 million barrels of oil represents a *lot* of economic activity that wont happen. Its a good thing for us that the impact will likely only be felt by the poorest members of oil dependent societies.

I'm sure you've heard similar stories Iskanda. People will enjoy a few years of uninterrupted electrical power (or telephone service), and then suffer a 15 minute or even one hour(!) outage. In that moment they will understand the complexity of the system. Even when the power returns they will still be afraid.

BTW, I can tried to talk to my neighbors about this. Most couldn't be concerned. One geek though tried to talk to me about "total system reliability" ... whatever that is. He got his calculator out and showed me that our papers got delivered 99.9% of the time.

My neighbors ARE IN DENIAL!

It's worth pointing out that the U.S. was able to accommodate its growth since 1970 by importing oil. Naturally with a global peak, there is no way to import the necessary oil to continue growth. We can’t import it from another planet.

What impact will even a 2% decline have on the world? It seems our current economic system requires growth to really function. Economies either grow or contract, it’s hard to just stay in a steady state because the dynamics involved have feedback loops. Let’s assume a 2% global decline in oil production compounding over time is enough to limit or eliminate growth and cause a global recession. At what point does it become a serious problem rather than a normal cycle? 2% could be a very big number, if the global economy spirals down in response.

I don’t have any different statistics – let’s go with 1% to 2%. I’m just saying it’s possible even a small continual decline in global oil production could have a big effect.

Oil is used in so much of the economy it’s hard to imagine it not causing difficult problems that could last a very long time. Not a die-off though. At some point people have to adapt, once they wrap their heads around the situation. But I just can’t picture certain places (like Atlanta) adapting very easily. And if it takes many years for the picture to come into focus, plus the reluctance of politicians to come right out and state the severity (like Carter did), you’re talking about several decades of really shocking lifestyle changes. Certainly the changes will be shocking to the people who thought it was going to be luxury living forever.

However….maybe growth isn’t as important as all that. I’ve often wondered, why can’t an economy or business simply make the same amount of money they made last year? They’re still making money, still living and so forth. Maybe it won’t be so bad. Maybe somehow the economy will grow in other ways, or find new ways to add value and increase quality of life over time.

But most of the people I talk to, see on T.V. and read about, growth seems to be like oxygen. It’s expected, required and inconceivable that it could ever end. With attitudes like that, I wonder if the current economy is structurally incapable of handling what lies ahead. Perhaps the current system simply doesn’t work unless growth is possible.

Throw in the other disasters-in-waiting like costs from severe storms (from warmer waters), the shaky dollar, resource issues (out of water, top soil), and it starts to look like too much to handle. These issues seem to be reaching critical stages at roughly the same time.

People are very adaptable though, so we’ll see. I still think a global depression and severe resource issues will likely occur before 2050.

A depression isn’t the end of the world, just a failure of a system that can’t be perfect and needs to change as the underlying assumptions no longer work.

If I were to cast off my parody posts (cracked me up), I'd ask why "growth" is presented as a uniform quantity, with the implication that all kinds of "growth" are equally oil dependent.

When your are talking about economic growth it might be of the oil intensive kind (air travel?) or it might be of the less intensive kind (solar farms?).

If I were to go further afield, I'd say that some kinds of growth that I value (growth in health and fitness) can happen even while economic and energy growth falter. Remember that Cuba's life expectancy went up in their oil crisis.

And then there is growth in knowledge and wisdom ... a bike ride to the library might be good for that, as well as for the circulatory system.

Sure if oil peaks and decline then growth cannot be exactly what it was ... that does not know we know what it will be.

It seems that a plateau and then a slow decline will give us plenty of time to adapt.

I'm a little more of a pessimist than JD but not much.

My position is this:

Light sweet crude peaked for the world in May 2005.

BUT....

We haven't seen a rapid collapse, in fact, we have seen an INCREASE in total liquids.

I figure this continues for at least a couple years more.

As for the rapid decline theory: I buy it, but not immediately.

Even if you take in the most doomerish position (i.e. the North Sea Oil model) go take a look at the graph. There are a couple of observations that can be made.

The first is that the rate of growth slowed big time in 1994 (growth was essentially static - a plateau). Then from 1998 it fell very, very slow (1% a year) then in 2002 it fell off a cliff.

Folks, that is EIGHT YEARS on a plateau. And that is for one single geographic region.

It's a not-unreasonable assumption to make that for the world as a whole we may see at least a decade and perhaps two decades on a slowly undulating plateau.

So, to to address the concerns of the rest who say, "ah but, peak oil is still real" yes it is, and the blogspot notwithstanding I don't think JD is saying that peak oil isn't real, I think he's saying that Jay Hansen is wrong, i.e. NO DIEOFF and no sudden collapse.

I for one think that if we have 10-20 years on a plateau we can move over ENTIRELY to an electric economy which is dependent purely on building infrastructure.

This kind of economy will of course also peak eventually, but the peak is not really the problem, is it? It's the decline.

And far as I can see an electric economy only has a peak and NO decline.

Now where's my plug-in prius?

I haven't read all the referenced articles yet, but thanks for providing them.

As far as the US decline since the 70's, do you think the shape of that curve would be the same if we didn't have the foreign oil to import? It seems likely that they would have taken extreme measures to slow the decline thus leading to a later more cliff-like decline. If so, won't that happen on a global level (where there is no "foreign" oil)? Have they been doing that in Saudi Arabia, for example?

Also, it seems like the possibly slow decline is due to occur when there are billions of people who suddenly are feeling somewhat entitled to a share of the remaining oil. So couldn't some, er, global friction occur as a result making the situation a little less, mmm, comfortable for everyone?

andy, the U.S. curve is for U.S. produced oil. it does not include foreign imports.

20 years seems like a long time, especially considering how much progress has been made in energy sciences in the last few years, but infrastructure changes take many many decades. it sounds scary.

consider this, however. if 10% of all vehicles in the US became plug in electrics (no long rollout of new infrastructure needed) in the next 10 years, that's 4% of our oil use right there (40% of U.S. total liquids goes to passenger vehicles and light trucks)

is that doable? i think so. the price of oil at the pump will help the process along. i only wish our government would have the balls to add a renewable energy tax to the gasoline pump.

Whether peak oil, overpopulation, global warming, Y2K--it doesn't matter. If a doomseeker seeks doom, the doomseeker will see doom in everything around him. Seeing doom becomes the overriding theme in such a person's life, his very reason for existence. Who are we to take this central ingredient of his life away from him?

'Proving' the future requires more than the referenced individuals are willing to take into account. I've noticed that in at least one case but suspect others guilty as well, those sections of, e.g., referenced SPE papers which fail to support desired result(s) are not mentioned. Then as well, to the extent economics is even considered, there seems poor grasp of the actual dynamics of the capital system which is quite a bit more than failed neoclassical theories.

A prediction business which can over and over be incorrect and always shift its certitute further and further into the future is no more than a propaganda or ideology, in this case one able to ride the 'green' wave that, when one gets right down to it, has more to do with perpetuating exactly the same system of relations which gave rise to today's severe environmental problems.

Most will admit that industrial capitalism played a large part in creating today's problems but then that same most seems to firmly believe the very same system will provide salvation, a belief somewhat disconnected from reality.

Odograph, you’re comment came off as both snarky and serious at the same time, so it was difficult to know which was which. But you’re point is this: that the system only works as well as the weakest link. Once one link goes missing the whole machine stops, whether it be a printing press, the electric grid, or the gasoline distribution system. We already saw spot shortages of diesel in North Dakota, Scotland, and Mexico last year. Spot fuel shortages, electric brownouts, blackouts, missing goods from supermarkets are going to become more common as a result of the breakdown of single points of failure in these complex systems that have no built-in redundancy.

I would be less worried about the world wide decline and more worried about our ability to acquire the liquids we need on a year to year basis. A 2% per annum world wide decline doesn’t mean that the US will have 2% less per year. It’s entirely conceivable as Mexico fields decline that they keep their current usage by paring down all that they export to us. The same goes for any exporting country. Arab countries have booming populations and their fossil fuel usage goes up year after year. That means less to export to us. As their fields decline, they won’t foment rebellion in their populations by reducing domestic consumption drastically. Most of that will be made up by reducing exports. The Saudis have so much invested, that they really could put the rest of their oil and gas production to domestic use and live off their investments almost indefinitely. A 2% per year worldwide decline could easily mean a 4% or greater decline for the US. There may not be oil to buy at any price.

The problem isn’t really how quickly or slowly the decline happens. In two decades, there will be less a lot less world wide oil available, and the USA will have even less of that, having been in depletion of our own oil for 30 years and as imports slow. Prices for oil during that time will be very high. Higher populations will demand more of that oil be used for food production, leaving even less for industry. Whether 2% or 4% or 6% we’re going to have a very difficult and expensive time transitioning to a different energy economy. America especially doesn’t have an infrastructure that can handle oil scarcity well. There will be economic recessions and suffering, there’s no way around it (there were even when there was plenty of oil. Energy scarcity will only exacerbate them). The time to act was in 1990, and we didn’t. The fits and starts in the alternative energy sector we’re seeing now are akin to being a couple miles offshore in the Bay of Fundy with the tide coming and beginning to stroll nonchalantly back to shore when you should be running. It has nothing to do with being a doomer. When you’re in a dangerous situation, you should have plenty of room for error. We haven’t left ourselves any.

Al fin, people are right to be worried. It’s hard for us to see life on the other side of the mountain with the view at the top so dazzling. But this view of gloom isn’t just someone’s opinion or neurotic worrying. It’s concern garnered through careful analysis of the data coupled with objective observation of our overly optimistic “free market” economic system and bought-and-paid-for politicians who answer both to corporate donors and to the voting public who want sunshine blown up there butts. Witness Hillary claiming oil prices will fall if she’s elected. She’s outright lying to play off people’s hopes and fears (not that I don’t think she’d be a better president than any of the trash the Republicans are putting forth).

3) I myself have pointed out the obvious tendency of large multi-country blocks (like continents etc.) to plateau for decades, including the amazing case of North America, which has been on an undulating plateau of about 14-15mbd for almost 30 years (Source BP Stat. Rev. 2007):

One thing I’d like to know about these numbers is the decline in ERoRI. You’re seeing loss of sweet light crude made up for with tar sands and shale, which are a lot more energy intensive. Are these numbers gross or net? What was the energy used to create these liquids each year?

JD, living in Japan, you may have lost perspective of how utterly dependent the USA is on oil, especially for transporting people and goods. It’s easy to do over there. The public transportation system is one of the best (the best?) on the planet. National law keeps food (esp. rice) prices sky high to keep Japanese farmers in business. The laws forbid building on farmland, tho I understand that’s been ignored somewhat recently. But most urban areas are still surrounded by farms, requiring a short trip to market. Traditional foods still make up a large part of the diet (gobo, daikon, rice, tofu, yamaimo, etc.) The population is falling, which is just what you need in an era of energy scarcity. Cars average 45 miles per gallon. Living arrangements are largely mix use with most Japanese living in apartments (“mansions”) above shops. Every errand can be done on foot or by train in most of the country. There are 10s of millions of people in Japan who live full and complete lives without ever owning a car from birth to death. The society is well-ordered, such that when energy scarcity does hit, there won’t be riots in the streets. Don’t bet on it over here, with our 300 million guns. Japan will have its issues, sure, but the fall from 11 barrels per person down to 5 is a lot less than 22 down to 5.

At what point has this blog shifted from debunking the peak oil theory to effectively saying "peak oil is real, but not so bad" as in this and other similar posts?

If this isn't a gradual intellectual retreat, I don't know what is.

Meanwhile, go over to other blogs like Housing Panic which have transitioned from "the bubble's going to burst and nobody's listening" to "nya nya, I told you so" mode.

At what point has this blog shifted from debunking the peak oil theory to effectively saying "peak oil is real, but not so bad" as in this and other similar posts?

There was no such point. This blog has always acknowledged that oil is finite and will peak someday -- from day one. The message has always been "peak oil is real, but not so bad". I selected the name "Peak Oil Debunked" for marketing purposes.

See 138. WHY CALL IT "PEAK OIL DEBUNKED"?

I selected the name "Peak Oil Debunked" for marketing purposes.

Here in the United States we call that SPIN, which is a form of dishonesty.

And the United states would not have stayed on the plateau with out Prudhoe bay, and the run up in Mexico with it's giant Cantrell, which both are in decline, with NO real replacement for them like they could replace the decline in production in the lower 48 states.

Mexico in a few years because of rising internal consumption could very well no longer export Oil like England and Indonesia have recently done. this is what happened to the US did for all practical purposes when the lower 48 peaked in 1970.

Off shore production because of the high costs will never get to the Texas 21st century production practices of 90%+ water cut with very small production levels comparative to the peak production. the reason is simple if the cost of the off shore wells fail to meet the expense of running the platforms, they will be abandoned.

I do not see the next 30 years in oil production being a repeat of the last, or any thing even close because most giant fields are in decline, and even Saudi Arabia's Ghawar is considered possibly in decline, with NO field any where on the planet able to replace it's historical levels of production.

Do I expect total collapse right away, NO

Do I expect things to get worse, like they are in Pakistan, Bangladesh, and quite a large part of Africa, yes .... Mexico for instance.

Even if we are capable of producing 73 million barrels of total liquids a day in 2040, the worlds population will be near 8.5 billion, not the 5.6 billion it had in 1995, the last time we got by on 73 million barrels of total liquid production.

Also in 2040, there will be many more people wanting use of that oil as part of the countries of china, India, Brazil and Russia, all who will be trying to use much more oil then they were in 1995, even the plateau you suggest is fraught with problems because far too many societies are trying to achieve the life style which needs MORE oil not a plateau especially a declining one.

So we need to change our ways of using this finite resource before the world wastes it like the western societies have done for over a century. However I doubt this is possible based on the feeble world reaction to global warming, and ability to solve the problems of the wretched poor all over this planet.

I see each block of nation states doing what they have done since the mid 18th century, going to war to fight over the limited assets of the planet; whether it be land, water, oil, coal because the country which can't acquire what it's society needs to grow.

Those that fail must stop growth, and that is a recipe for chaos with devastating results if large groups of nations use modern weaponry to attack other nations. Such attacks will include destroying their recourse and industrial capability, like was done to Japan and Germany in WW2.

However this time far too much of the planet lives life based on a continuous supply of resources. Any interruption to these essential resources will cause collapse in the intractable systems which we all use to live the lives we are accustomed to.

In such a scenario, the ability to maintain the plateau goes out the window. If you think this is not possible, just convince yourself George W Bush and Richard Cheney have NO plans to attack Iran, before they leave office in Jan 2009.

That is not something I can realistically do at the moment.

cliff,

Of course all the ideas about changeover and/or graceful powerdown can't happen if Cheney/Bush plunge the world into global nuclear war.

But you know what?

There's NO POINT in discussing it.

Under any credible scenario, you will not survive. No matter what kind of doomer porn fantasy you have about killing off hordes of mutant zombies with your M-60 and living off of your stockpiled canned foods, you are screwed.

Most major cities will be recipient of MULTIPLE nukes. Not just a single nuke.

Even smaller cities of 10,000 people or so will be nuked.

In this scenario, how do you propose to survive?

Thus the point is moot.

It's akin to saying "one day I will be dead, how can I prepare myself for after that event".

You can't.

Waste of time.

As for the export land model:

Why, exactly do you think we are in Iraq?

We don't NEED to take Iran's oil, there are other places. And far as I can see the most likely opponent (China) won't fight us for oil in our own backyard. They will only do so if desperate. To be honest, I suspect the Chinese will be able to muddle through peak oil better than us.

Do you think that the US will ALLOW Mexico to say "no exports gringos"?

Do you think that the US will ALLOW Venezuela to say "no exports gringos"?

There is still such a thing as the Monroe Doctrine remember.

Of course all the ideas about changeover and/or graceful powerdown can't happen if Cheney/Bush plunge the world into global nuclear war.

They obviously think so, or maybe it is just they really don't plan on any graceful transition in the first place.

But you know what?

There's NO POINT in discussing it.

Under any credible scenario, you will not survive. No matter what kind of doomer porn fantasy you have about killing off hordes of mutant zombies with your M-60 and living off of your stockpiled canned foods, you are screwed.

Nice dodge at inventing a strawman argument I never stated. I have NO doomer fantasy, just questions about how this really will work out, and a lot less optimism it will be as easy as some think.

Most major cities will be recipient of MULTIPLE nukes. Not just a single nuke.

Even smaller cities of 10,000 people or so will be nuked.

In this scenario, how do you propose to survive?

Didn't say I would did I?

But then again, that is the question, how do we all survive as well as we can with SOME people advocating grabbing as much as they can for themselves and increasing the chances of a nuclear war for all.

Thus the point is moot.

It's akin to saying "one day I will be dead, how can I prepare myself for after that event".

You can't.

Waste of time.

Only if you refuse to admit that is a very REAL possibility if some people keep trying to grab the lions share of the planets resources for themselves to the detriment of the rest of the planet.

like YOU do below.

As for the export land model:

Why, exactly do you think we are in Iraq?

BTW exactly how well is that going?

Has oil production gotten back to the levels Saddam was producing almost 5 years after he was deposed?

The ELM is NOT about grabbing OIL thru war, it is what is happening when the oil production in exporting countries fails to rise fast enough to meet both internal and external demands.

We don't NEED to take Iran's oil, there are other places.

Good luck TAKING anybody's oil in the future.

And far as I can see the most likely opponent (China) won't fight us for oil in our own backyard.

No but using a strategy we used in Afghanistan during the 1980's the Chinese can easily arm the vast number of people south of our border to make OUR attempt become mission impossible instead of mission accomplished.

That would tie up large parts of our already over extended military that would allow them to move in areas much nearer to them.

They will only do so if desperate.

In a world with rising demand and limited production, desperation could very well become the new normal.

To be honest, I suspect the Chinese will be able to muddle through peak oil better than us.

Not anything to disagree with here especially since we exported a large part of our industrial capacity to them for cheap mao-mart goods.

That and the fact we have worn our a large percentage of our military's hardware, so a quick turn around and attack to seize oil in this hemisphere ain't gonna be a cake walk either.

Do you think that the US will ALLOW Mexico to say "no exports gringos"?

With fourth generation war fare strategy, and associated tactics of hit and run against fixed large complex targets, I would say they could quite very well do this;

remember the Germans never thought the Yugoslavians forces could tie them up in the Balkans,

neither did the British thinks a rabble rousing rag tag army of farmers and craftsman could fight the greatest military force to a stand still in one of their colonies.

or the soviets think a backwards group using horses beat a super power.

neither did the Japanese think Vietnamese would be hard to subdue, nor did the French, and of course Americans.

and the French didn't think the Algerians would be formidable when they started to suppress their revolt in the late 1950's

nice try but the world military history are littered with the enormous numbers of the bodies of soldiers because of generals who claimed the very same thing.

Do you think that the US will ALLOW Venezuela to say "no exports gringos"?

Like we will really have a choice, after all we can't force then to just roll over and give up; see above.

There is still such a thing as the Monroe Doctrine remember.

Right and just who's army, military equipment industrial base, and financial resources are you gonna use to forge a decades long losing war for the dwindling resources.

which BTW are not gonna be any easier to produce in the enviroment which an US grab will entail then the Iraqi oil has been.

Jeremy, the point of my story was that people go on about "single points of failure" while ignoring 99.9% up-time.

You may have the chops to find a "single point" in your local services, but it gets harder as we scale back to city, state, and national level.

In fact it becomes impossible, which is why people try fuzzy arguments about "maximum complexity" and etc.

No, the reason that most "doomseekers" would not survive any significant global cataclysm is because they are wrapped in their fears, rather than carefully monitoring real data.

Every "conscious agent" operates with a bias of some type. With doomseekers, the bias is toward catastrohic doom, or apocalyptic cataclysm. This is the lens through which they view the world.

JD tries to present a clearer picture of reality. It is not JD's personal viewpoint that is important so much as the confirmable data that JD presents. His viewpoint "fleshes out" the data into a narrative that is easier to understand. A narrative that does not end in gloom and doom.

Defeatist narratives of doomseekers that end with 6 billion dead humans on the planet are not worth contemplating. Not only because of the low probability scenarios they concoct, but because when skiing down a steep forested slope, your chance of survival is much better if you look at the clear paths--not the trees!

There is just one thing I have to say: Wether we run out sooner or later is completely irrelevant. We'd better have a plan B. But we haven't! How stupid is that? It is time to develop plan B now, while we still have plenty of oil left. Whatever nitpicking happens on this site or at TheOilDrum is just plain st***d. We need to prepare now, while we have time and only 6,8 billion people and 600 million cars on the planet.

Well, my 'yada yada' about the capital system should be partially unpackaged.

All the talk of smooth or at least relatively smooth shifting from carbon based energy to other forms must come to grips with the basic fact that sufficient investment in those other forms will only take place to the extent that such investment returns a higher than average rate of profit and is expected to continue to do so.

To imagine other wise is to imagine that capitalism is not capitalism, is to imagine that this world dominant set of social relations is driven by human and ecological needs rather than a system-inherent profit and accumulation imperitive.

I think it no coincidence that post-WWII America saw the rise of a systems approach or technocratic military-industrial-university complex within which "military funding contributed enormously to the launching of the computer and communications industry, the commercial aerospace industry, and the electronics industry that flourish today." (Hughes, Thomas P.)

Nor do I find it coincidental that, faced with the prospect of falling profits, winding down of the VietNam war and developing fiscal crisis that the above mentioned complex would seek new state sponsored opportunities such as at least partial creation of, as it was called at the time, a social-industrial complex.

So, in lead up to 'The White House Conference on the Industrial World Ahead', President Nixon announced that:

" ... The private enterprise system is facing new challenges on every front. Corporations are being called upon increasingly to help provide solutions to complex national, social, and economic problems. Business, labor, and government must work in partnership for the public good.

Plans must be made now to make the most of the opportunities ahead. I feel it is time for key leaders with an interest in our industrial society to take a long range look and develop policies that will help shape that future. ... " (The American Presidency Project)

A summary for which noted:

Approximately 1,500 key business, labor, university, and government leaders met to consider the issues, challenges, and opportunities confronting the American private enterprise system in the coming two decades and the adaptations to change that will be needed. [And]

that business, labor, and educators are able to influence the direction of things to come and to help build an improved system with government and the private economy as partners.' (USGPO)

One of the most interesting presentations was made by Dr Simon Ramo (TRW) who, per very foggy recollection, spoke to the real possibilities for a vastly improved national communications system, new inter and intra-urban transport, better town and city planning, pollution control and cleaning up Lake Erie, et cetera. All in all quite impressive and not so distinct from what we hear today, though of course the communications side has largely been realized.

But, lets return to the 1960s.

"Richard Barnet in his The Economy of Death published in 1969 detailed the rise of the new super-rich like David Packard, who parlayed an electronic hobby in his garage into a $300 million personal fortune by the mid 1960s; Simon Ramo and Dean E Wooldridge of TRW, which catapulted from a $6,000 operation in auto parts into a $120 million defense contractor by 1967. Since these companies were involved in selling threat reducers, it was necessary for them to first sell threats. James Ling, the founder of LTV, who with a $3,000 investment built a $3.2 billion business, declared to the press, One must believe in the long term threat. (Liu, Henry C K, Asia Times, 2003)

Which is not to say there will never be peak oil but that the threat of such became, lets say, part of a larger multi-decade promotion.

Hi there, just found your site after reading a lot of the LATOC stuff.

I think that the coming 'peak' will be very disappointing for a lot of the doomsayers. Unfortunately for them, reality is a lot more boring than their fantastical visions of the future.

As always the real situation will be somewhere in the middle.

Sorry lefties - there won't be mass casualities on wall street as traders jump through plate glass. The elite will not be lynched by angry mobs of ratbags in dreadlocks and puff hats.

Corporations will not (by and large) vanish unless their whole income base relies on petrochemicals.. take BP for example who saw the writing on the wall a long time ago.

So I'm afraid that it's B.A.U pretty much as we switch over to non-fossil technologies while the old stuff gets more expensive.

In case you doubt, consider this: nymex has gone from $60 to $100 a barrel over the last year mainly for geopolitical reasons..

..But according to LATOC we should all be drinking our own urine by now.

JD -

Matthew Simmons has just released a 15-page paper he wrote November 16th, 2007.

It's pretty good. It would be interesting to see you critique it.

I will be soon on

http://netoilexports.blogspot.com

December 2007 C+C production will most likely come out at 74.9 mbpd beating the May and Dec 2005 level of 74.3 mbpd.

-MFP

Matthew Simmons: Another Nail in the Coffin of the Case Against Peak Oil (PDF)

netoilexports.blogspot.com

Just wondering...won't economic growth continue in some form due to a combination of both conservation and effieciency mandates (say we need 1 million barrels of extra oil for growth, but save 1.5 million through policy changes) and a rise in alternate fuels? If 75% of the US driving population uses their car, on average, for 60 miles a day, that's enough for a single battery charge from an electric car. Start pumping those out, combine them with ride-share programs, and a huge amount of gasoline use goes out the window. I know this is a simple argument, but it's 4 in the morning and I think you get my point...

Actually, I think it's the Chinese who will be plugging-in electric cars, as they're building three coal-fired power stations a day to generate the juice. The US, the UK (where I am) and Europe are more dependent on natural gas for electricity.

For one thing, if the oil is starting to decline, NG will soon follow. For another, how many new power plants are being built in the US and Europe?

I'm not advocating coal fired electricity, by the way (even though I do live more than seven metres above sea level, so Greenland can melt without messing up my carpets).

The point is, it's only one planet. Even a gentle decline in oil production, if sustained, means making widespread improvements to energy efficiency just to stand still.

It's true that coal is an ugly ass fossil fuel but it's also true that it's much easier to clean up a few thousand coal powered plants than it is to mandate Joe Sixpack drives a prius instead of an F-150.

From that perspective, it will be easier to (slowly) get the public onto plug-ins and then afterwards we have the option to ramp up to wind et cetera while just keeping a limited amount of coal for baseload.

In an ideal world we find some cheap way to store electricity generated from wind then we could scale it all the way up.

I read that you guys in the UK have a government plan to install 7000 some turbines - enough plated capacity to power the whole country. If that's right, then doing a straight scale up, we'd need about 10 times that number to power the US (assuming like for like). Pretty easy I think.

Yes thats correct. Tis a lot of wind power, coupled with next generation nuclear baseload generating reactors. The government seem to be on the right track....

popmonkey, you missed my point. I know the curve is for US production. My question is, would the curve look the same if the US had had to rely only on its own production and not been able to import extra oil (real cheap). That's where the world is now -- where the US was then. Only there is no foreign oil for the world to import. So I've heard that companies are using techniques to keep production up, when they should perhaps be on the back side of the peak. And that doesn't change how much oil there is, just how long it takes to extract it.

Andy in San Diego, so what you're saying is: without imports the U.S. would have been scrambling to push oil production much harder than it needed to thus causing a steeper falloff?

you may have a point there but otoh, why wouldn't U.S. owned oil fields not pump at max anyway. because oil was cheap? could be. still, there was money to be made and i would be hard pressed to believe that companies would not pump at max.

in fact, a lot of hubbert heads like to talk about the "lower 48 states decline despite high tech and pumping at max"...

Anonymous who said:

It's true that coal is an ugly ass fossil fuel but it's also true that it's much easier to clean up a few thousand coal powered plants than it is to mandate Joe Sixpack drives a prius instead of an F-150.

yes, that is true and i totally agree, however there is absolutely 0 reason not to attack the problem from all directions. and one direction would be to make low mileage vehicles "uncool" and plug-in hybrids and their ilk "uber-cool".

take recycling, for example. it starts at the home. people do a lot of otherwise very expensive sorting almost automatically before the trucks even come to pick your shit up.

the prius has some ridiculously fun stuff about it. that display they built in is brilliant. it makes driving a hybrid super fun. they should add a high score board for "my best mileage run" etc and turn it into a game... i'm totally serious... people play those little games all the time. make 'em part of the efficiency equation.

JD, hi, I used to read you and correspond with you two years ago, then got too busy for PO. You realize of course that even a 1% contraction in supply will be a disaster in the face of growing demand, don't you? And it also upsets the endless growth paradigm on which the world's economy depends. I read this blog entry by you as confirmation of some of the worst PO doomerism. Do you realize you are now a doomer without seeming to know it?

finiteresource: The U.S. is not more dependent on natural gas than coal for electricity. Fifty percent of its electricity comes from coal and nuclear is in second place with 20%.

anon 01:16:00 AM

you are correct to say 'endless growth paradigm' but every stagnation/recession/depression points out the limits to such paradigm, limits which are endogenous rather than imposed from the outside.

Differently, capitalism is not infinite but an historically limited system that can decay or be transcended.

PO =

Total quantity unknown

Withdrawal from total quantity unknown

Future means of withdrawal unknown

Future economic change unknown

We havent had a geological peak. This is because we haven't pumped from every available source. The choicest sources of oil remain shut to western companies.

After the invasion of Iraq, western oil majors estimated that the total oil in the ground in Iraq was probably twice what had been originally estimated. This is likely to be the case in many other countries too which have indulged in resource nationalism and prevented major oil companies from exploring within their boundaries.

Secondly, the total amount of "oil source" available is huge - I am now including in that list the oil sands, the oil shales and all the stuff that's sitting in the Orinoco in Venezuela. While it is true that we cannot pump that stuff in reasonable quantities today, that is not to say that with the current huge investments in oil exploration and research, we wouldn't be able to do so in 20 years from now. Twenty years ago, we wouldn't have been able to extract much out of the oil sands in Canada. Today production there is 1 million barrels a day and rising.

So Peak Oil has occurred or is occurring only with respect to light sweet crude (and even here I insist that if unlimited access to all oil reserves in the globe were given to Western oil companies, peak oil would not happen for at least another decade - and that is a conservative estimate).

Lastly, I am amazed at how badly we use Natural Gas. I am from India and in Delhi all the buses and the taxis run on natural gas. Air pollution levels plummeted after the government forced all buses and taxis to run on gas and switch from Diesel. The gas they use is not LNG - but CNG (Compressed Natural Gas) and it works perfectly well. The world's total endowment of Natural Gas is in the order of 2.5 trillion barrels of crude oil equivalent. Gas alone could see us through the next couple of decades with ease.

So in other words, "Peak Oil" (in its current form) is not a problem.

This is an interesting view, esp. since you are from India and India is growing. Here in the U.S. we have a honda that can run off of Natural Gas, gets 170 miles before you need to fill it, and it comes with it's own fueling station. This may be part of the fact that your country has not increased it's demand for Oil by too much. Interesting indeed. And you guys are getting along well I would take it. Yet you only use about half of what we here in the U.S. uses. Also I am a gamer and I know that India has a pretty bada$$ version of Xbox LIVE over there.

Also your view coming from the other side of the world so to speak about supplys in oil are intersting as well.

However I would disagree that "Peak Oil" is not a problem, because it is a problem. However if you're right, then perhaps we'll have enough time to mitigate our ecnomys without a real bumpy road to travel down.

Sorry, but whoever said the problem was a rapid decline? The problem is the gap between demand and supply. Okay, oil supply might only decline by 1% a year, but demand is climbing so that the difference will be 2% then 3% and on and on....you're creating a straw man argument to knock down. It isn't the end of oil, it's the end of cheap oil that's the problem. And no, the economy isn't going to collapse now or next year, but all previous collapsed civilisations did so because their energy capture methods were vulnerable to the law of diminished returns...that's what'll get us in the end.

odograph, I work at a small newspaper office, and where I sit is right next to where the circulation department rolls and bags their papers, so you have no idea how much you just cracked me up. Thanks for that. :-)

For the people unfamiliar with the newspaper world, newspaper carriers nowadays tend to be...um...how should I put this...they're often either the people who can't hold down a job at the local McDonald's (and indeed, often aren't stable enough to hold down a job at the local dump) or they're just supplementing their income...either way, a lot of 'em aren't the most reliable folk on the face of the earth.

And I think you hit the nail on the head, the mistake the Peak Oilers are making: Correlation is not causation, and data points fitting a theory don't necessarily mean you were right, and that further research may be necessary.

To maintain world economic growth at current rates it would appear we need oil supply to grow at 2%, but if its declining at 1-2% then we are going to get a lot slower growth. Population growth would have to decline rapidly to stop living standards from falling.

So while its not going to be the end of the world, it could be a lot worse than the 1970's.

This comment has been removed by the author.

What people ted to forget is that American are paying $2.5/gallon while most of the rest of the world has significant taxes on gasoline already, giving an effective cost of ~$8/gallon. In a world with decreasing oil production who is going to give up a barrel of oil consumption first? I say America, we use it most inefficiently, and a $1 increase affects us more as a percentage increase than for the rest of the world.

Post a Comment

<< Home