253. MONOPOLISTS SITTING ON OIL

As reported on Feb. 28, 2006 in an article in Resource Investor, Lord Browne (the head of BP) had some interesting things to say about peak oil recently:

“[Peak oil] is a myth you will find reinforced in most newspapers every day… [that oil and gas are running out, and that we are walking towards the edge of the cliff.] I went into one bookshop here in London and found that there was a special display of 14 different books published over the last year with titles such as 'The End of Oil' and 'Twilight in the Desert.' The idea that oil is running out is simply untrue. There is no physical shortage of oil or gas. The reality is that the physical resource base is strong, and the amount which we can recover from that base is being expanded by technology all the time," he said.SourceNote, however, that Lord Browne is not saying everything is hunky-dory. He says we have a serious problem. The problem is not that we are running short of oil, but rather that the countries which do have large volumes of oil (particularly Saudi Arabia, Russia, Iran and Iraq) are sitting on it. As he puts it:

Unless the geologists succeed in finding new and so far unidentified provinces…we will all be dependent on supplies from just three areas – West Africa, Russia and, most important of all, the five states around the Persian Gulf, led by Iran, Iraq and Saudi Arabia.It's pretty easy to read between the lines here. Essentially, he is accusing these countries of being monopolists, engaging in anti-competitive practices in order to milk the wallets of their consumers. Now, Iraq obviously can't be branded with this label due to the war. They're sitting on their oil, but it's not their fault (or at least not the fault of the Iraqi government). So let's leave them out of it.

The resources on which we are going to rely are closed to investment by any private company. The decisions on investment and production are controlled by Governments…which may not always be aligned with the interests of international consumers. (Source: same as above)

Let's look instead at Saudi Arabia. The country (like Iraq and Iran) is literally covered with oil fields which have already been discovered, as you can plainly see in the following maps from the USGS. Each green dot indicates an oil field, and the vast majority of these fields are undeveloped, just sitting there, idle under the sand. (Click to enlarge):

So the question is: Why don't these countries open up to foreign investment, so companies like BP can get in there and pump that oil?

I think we all know the answer to that question. They don't do that because they are monopolists, and they can make a lot more money by loafing and letting the price rise. It's classic cartel behavior. They don't want anybody else pumping their oil for the same reason that Disney doesn't want anybody else selling their movies and Mickey Mouse paraphernelia; they'll get undercut by more efficient competition and they won't be able to exact their monopolist's royalty.

Of course, the peak oilers have a different view of this situation. They say Saudi Arabia, Iran, Iraq and Russia are all tapped out, running at capacity. We are at peak and it is geologically and technically impossible for these countries to increase their oil production further. But if that's the case, then what do they have to lose by opening up to foreign investors like BP? The majors will just move in, waste a bunch of money trying to produce oil which isn't there, and leave. I don't get it. What are they being so protective of, if there's nothing there?

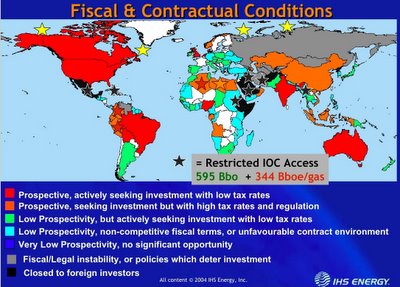

All the big fish are closed to competition, just like Lord Browne says (click to enlarge):

"From 1995 to 2004, fewer than 30 new wildcat [exploration] wells were drilled in Saudi Arabia, compared with more than 15,700 in the United States."Source

That sounds like loafing to me.

Venezuela: They have heavy massive heavy oil deposits just like Canada. But Canada's production is on-fire, going up every year because it is open to foreign investment, and the investment is pouring in. Venezuela, on the other hand, is discouraging investment, and making frequent threats to stop supplying oil. That also sounds like loafing to me.

-- by JD

2 Comments:

Thomas, I appreciate your frank comments. I don't have time at the moment to reply in detail (although I will tomorrow). In the meantime, let me ask: What was about it the sources used in this post, or the credibility I assigned to them, that you found biased? I honestly would like to know where you felt there was bias.

A lot of people are just upset for having been taken in by the PO doomseekers. If JD points out that their numbers are wrong, they hit the ceiling. Some people only want bad news.

Post a Comment

<< Home