313. STUART STANIFORD BLOWS CALL ON SAUDI ARABIA

On March 3, 2007, Stuart Staniford made some very ominous, pee-your-pants-type predictions about Saudi Arabia in the post "Saudi Arabian Oil declines 8% in 2006".

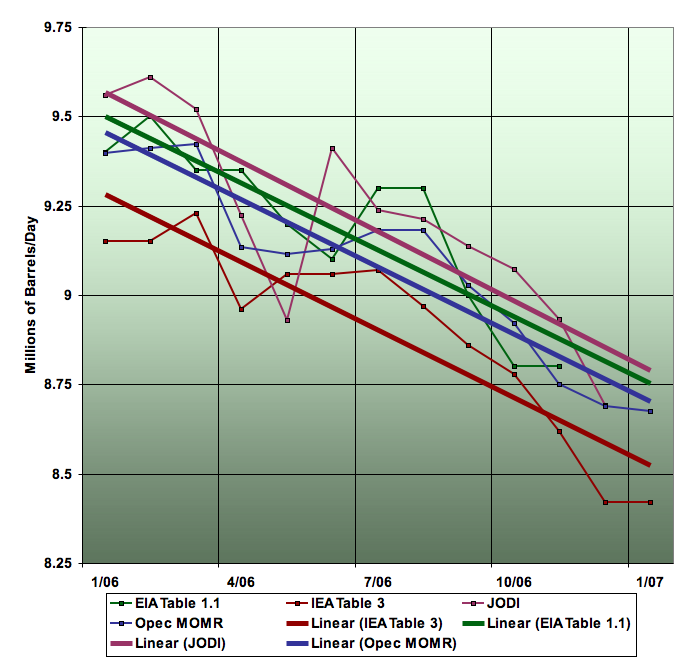

He shows the decline in this graph, illustrating Saudi production data from the various indicated sources (click to enlarge):

Using this graph, Stuart determines that the Saudi's are caught in unstoppable, plummeting decline, as indicated in the following passage (emphasis mine):

My intepretation is that the bump in the middle of the year that separates the two lines is due to the impact of Haradh III coming on stream. So that tells us that, given some extra production capacity, Saudi Aramco immediately threw it into the production mix. And the effect of that? It lifted the plummeting production curve up by 300kbpd, but did nothing to change the gradient of the plummet. That suggests that the Saudis had nothing else to throw at the problem.

It also suggests that last year's underlying Type II decline rate, before megaprojects like Haradh III, was 14%.

Overall, I feel this data is clear enough that I'm willing to go out on a limb and conclude the following:

* Saudi Arabian oil production is now in decline.

* The decline rate during the first year is very high (8%), akin to decline rates in other places developed with modern horizontal drilling techniques such as the North Sea.

* Declines are rather unlikely to be arrested, and may well accelerate.

* Matt Simmons appears to be right in Twilight in the Desert, but the warning did not come until after declines had actually begun.

[Update: Steve Andrews of ASPO-USA correctly points out to me in email that Matt Simmons began warnings about Saudi Arabia as early as December 2003, significantly before the publication of the hardback version of the book in mid 2005. I relied on an over-hasty check of Amazon which has the paperback publication date - mea culpa.]

I suggest that this is likely to place severe political strains on Saudi Arabia within a year or two at most.

What actually happened in 2007?

Dialing up the 2007 production stats for Saudi Arabia over at the EIA, we get:

January 8.75mbd

February 8.6mbd

March 8.6mbd

April 8.6mbd

May 8.6mbd

June 8.6mbd

August 8.6mbd

No decline. Nothing unusual. Just standard, steady-state production like we've come to expect from Saudi Arabia.

How did they arrest the plummet, Stuart? With those tank farms Matt Simmons claims they've been using to cover their decline ever since "Twilight in the Desert" came out?

The most ironic part: Stuart includes an "Update" crediting prediction of the Saudi plummet to Simmons all the way back in 2003! So... given that the plummet has failed to materialize, we are now going on 5 fucking years of Simmons prattling on about the Saudi's going over a cliff any day now. And it still hasn't happened! (Let's all pray that the Saudi's don't start raising production any time soon. I don't think any of us wants to contemplate the horrible tsunami of mockery and ridicule that would unleash.)

[Note: Two posts today, folks. Don't miss #312 below. It's even better than this one. Oh... and don't forget to push the Digg button!]

by JD

11 Comments:

We are really in trouble when all the naysayers have is that there was no decline. Not a rise, not growth, just flat production. And that is in the age of Peak oil GOOD news. What were the Saudi export numbers? Did you miss the detail in Stuarts presentations where he indicated there were some new projects coming on line in 2007 late in the year allowing production to rise briefly - which did not happen. Lets see what 2008 brings. Oh, and 2007 Saudi production was still down from 2006 production - if you would check.

You do a great job with selected data. The Saudi's have fallen off a cliff.

2005: 9.6

2006: 9.2

2007: 8.6 (so far)

Kinda makes you wonder why the Saudi's have tuned off the tap.

Again, good to see a little common sense injected into the doomer hype. The doomers love to point out when optimistic projections fail, but rarely, if ever, want to do a retrospective on their own failed predictions.

Stuart made a call based on a year or so worth of data, and was dead wrong. The 8% decline number simply has not materialized.

Easy to see what website failed maths (or 'math' in American). You should rename your site - "common sense debunked".

" The Saudi's have fallen off a :::cliff.:::

2005: 9.6

2006: 9.2

2007: 8.6 (so far)"

LMAO. That's a proverbial cliff?? Doom! Doom! Seriously though, I was hoping for more dramatic numbers; I won't be happy until we shoot past $110/bbl.

Doomers seem to have reading comprehension problems. Stuart boldly predicted, based on some lines drawn on a graph:

"Declines are rather unlikely to be arrested, and may well accelerate."

Stuart could not have been more wrong. The exact opposite has occurred (i.e., declines have been arrested, and thus did not accelerate).

Stuart did not say "let's see what 2008 brings," nor did JD claim that Saudi production did not decrease in the recent past, so I fail to see the relevance of these points.

Fair enough JD. You have a point. As Stuart warned when making his predictions: he went out on limb, and it snapped off. Kudo's to you for rubbing that in. The decline that Stuart noticed was there, but appears to have been voluntary, enabling Saudi production to be held steady for 2007.

More interesting is the question why? Why have the Saudi's allowed the oil price to approach $100 by inaction? Why not up production back to 2006 levels?

Perhaps more importantly: if the Saudi's appear to allow their production to slump almost 1mbpd voluntarily, helping cause in effect a 50% rise in the oilprice, then by what criterion might we detect Saudi peak oil when it does appear?

Clearly, you've shown that a rapid fall in Saudi production and a resulting 50% jump in oil prices is no justification per se for a Saudi peak. If anything, that development is not comforting.

@jevandorp

You ask questions a lot of people ask, the problem is they don't have a hard answer, so people fill the blank with pet theories. There is simply not enough information to draw the sort of conclusions peak oilers like to make.

"Why have the Saudi's allowed the oil price to approach $100 by inaction?"

For questions of motivation, you have to ask the Saudis, we can only guess their reasons. They might not even know themselves..

I believe the Saudis are more constrained by OPEC than anything else. The rest of OPEC cannot increase production so if KSA raised output, the rest of OPEC would lose out.

"what criterion might we detect Saudi peak oil when it does appear?"

We can't. In a theoretical model where the production curve is only constrained by reserves then you get a neat logistic, but in the real world the production curve can be anything. We don't know what Saudis reserves really are, and estimating URR from production is unreliable because production is constrained by OPEC quotas. The only way we will find out is by hindsight.

That doesn't mean we have to wait in order to wean ourselves off oil. There are many reasons to start doing that already.

"As Stuart warned when making his predictions: he went out on limb, and it snapped off."

Jevondorp, I'm not singling you out, so please don't interpret this post as some kind of attack against you. That said, what you wrote points to the psuedo-scientific roots underlying much of the so-called PO "research." IIRC, Staniford is one of those guys who wears his Ph.D like some kind of entitlement badge, talking up his own work and talking down any dissenters (he represents perhaps the most obnoxious PO faction of all). In any case, the point is that there is a statistically rigorous and methodical way to test hypotheses, and it falls under the epynonymous title of Hypothesis Testing. IOW, there is NOTHING scientific about perusing data and going "out on a limb," as it were. Where is the formalism? There is none. It was a hunch; a premature, udersubstantied and ill-advised one at that.

That kind of "analysis" reeks of really dubious reasoning, especially for someone who repeatedly hoists his mathematical and academic credentials up on the proverbial flagpole for everyone to admire. Color me unimpressed.

bc and dc: Points well taken.

But one thing: Clearly, there is no way to predict to within 6 to 12 months (as JD seems to demand) Saudi Peak Oil - let alone global Peak Oil - with any kind of formalism in the understood abscence of sufficient data. It's all (educated) guesswork. That doesn't mean we are forced to sit back and do nothing, because you can use what little information there is in a rational way.

Staniford did so when he noticed a 'plummeting' fall in Saudi oil production during a period of high-and-rising oil prices. He then worked out his out-on-a-limb prognosis based on the hypothesis that the Saudi's were already in the peak oil decline phase, knowing full well that it was obviously too early to call Saudi peak oil.

Staniford's prognosis for Saudi, and world production failed because his hypothesis that the Saudi's were in peak production failed. This happens all the time in science. No big deal.

Now Stuart is claiming this wasn't a prediction but rather a scenario.

Looking at the comments made at the time these scenarios/forecasts were originally posted, I suspect most readers did not comprehend this distinction, especially when Stuart was saying "this is baseline; I believe the decline rate will accelerate."

Does anyone seriously think Stuart wouldn't have been taking credit for calling the peak, had his "scenarios" been correct?

Post a Comment

<< Home