175. TYPE III DECLINE

When a country is past its peak (like the U.S.), total oil production for the country declines by a certain percentage each year. This percentage is called the Type III decline rate of that country.

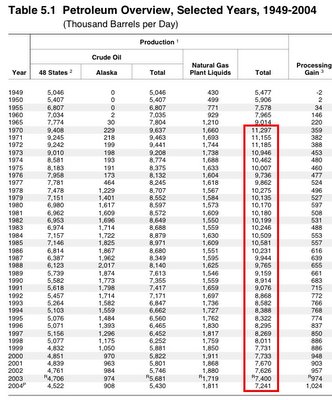

As an example, let's look at the decline of the U.S. since its peak in 1971. As you can see in the Table below (from the 2004 Annual Energy Review, DOE), U.S. oil production (including NGL) peaked in 1970 at 11,297,000 barrels per day, and has been declining ever since (click images to enlarge):

From these stats we can calculate Type III decline in the U.S. for each year since 1971:

As you can see, the rate fluctuates greatly. In some years there is a steep decline (1989: -6.6%), and in other years it doesn't decline at all (i.e. 1980-1985). The average decline rate over the last 34 years has been a mild 1.3%.

On the face of it, this seems to be good news. At some point, the entire world will decline, but if the U.S. is a good model of the world, we can expect the world to decline at a mild rate of 1-2%. Is the U.S. a good model of the world?

To answer that question, I asked Rembrandt to help me calculate the total decline for all countries in Type III decline (not just the U.S.) My reasoning was this: The set of all countries in Type III decline is a larger sample, so the Type III decline rate for that set of countries should give a better approximation of total decline for the entire world in the post-peak period.

So which countries are in Type III decline? Here's the ASPO list from a presentation (ppt) by Colin Campbell and Jerry Gilbert:

This list has a number of problems, as Rembrandt points out:

Brazil, only non-deepwater has peaked

Venezuela only conventional

Iran has had one peak but not yet a second one

Russia one peak but not a second one

And they are also counting small countries (Netherlands, Chile,

sharjah? (I have never even heard of sharjah..)

He also has this to add:

I have 46 separate countries in my spreadsheet with the other countries on a

bulk (other South Africa, other Europa etc.). This follows the same method as in the attachment (world oil production pages from the latest data from the IEA statistics journal). Of these countries I can only see 21 that have for certain peaked (and are in type III decline) and will not show production increases to all likeliness, those are:

Indonesia, USA, Canada (conventional), Argentina, Colombia, Ecuador, United Kingdom, Norway, Italy, Romania, Oman, Syria, Yemen, Cameroon, Egypt, Gabon,Tunisia, Australia, Brunei, Papua New Guinea, Uzbekistan.

Then there are countries that will to all likeliness peak between 2005 and 2010, those are:

Denmark, Mexico, Congo Brazzaville, China, India, Malaysia, Peru (2nd peak)

Then there are countries that might peak between 2005 and 2010 but I am not really sure of that given the amount of data I gather. And when I don't have enough data I don't do anything although I have the feeling that these figures are quite accurate, it's unscientific to guess.

Qatar, Venezuela (conventional, maybe already peaked), Angola (2010), Nigeria (2010), Russia (2010?).

And then we have the Middle-Eastern countries (Iran, Saudi Arabia, United Arab Emirates and Kuwait) of whom I do not think that they will peak in the near-term future. Maybe around 2015, or later, but nobody really knows what's going to happen there.

From the numbers above it shows that you can "stretch" the number towards 50 that have peaked. The only number that I kind off trust: 33 countries out of 48 that have peaked according to Chevron (willyoujoinus.com). This is quite similar to the numbers that I get (46 large countries in my spreadsheet, and also counting the countries that have peaked in 2005 and are going to

peak in the coming years gives around 30 to 46).

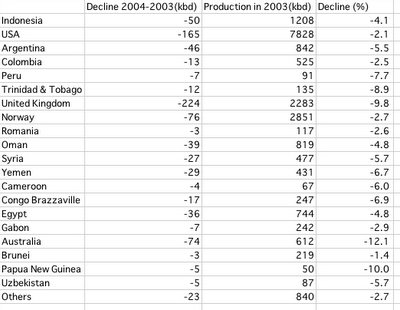

So let's focus on the countries which are truly in Type III depletion, and look at their Type III decline rates. Rembrandt was kind enough to supply the following data from the IEA (which includes conventional and non-conventional oil, and NGL):

This is not such a soothing picture. Clearly the U.S. is the anomaly, with the 2nd lowest decline rate (after Brunei). Total depletion for this set of countries is about 4.3%, much higher than the 1.3% figure for the U.S. alone. Furthermore, some of these countries have decline rates which are atrocious: Australia -12%, Papua New Guinea -10%, UK -10%, Trinidad & Tobago -9%.

There are a few points to note:

1) Due to the nature of the arithmetic, the world's Type III decline rate will be dominated by the decline rates of the largest producing countries -- i.e. the U.S., Saudi Arabia and Russia. At the moment, the U.S. is the only thing keeping the Type III decline rate for all declining countries at a semi-reasonable level of 4.3%.

2) While severe declines in individual countries may not pose fatal problems to the world oil market, they clearly do pose serious problems for the countries themselves. Indonesia, for example, will continue to relentlessly lose foreign exchange earnings, and it's unclear where that process might end up. Mexico is likely to come under similar stress. Where will they get dollars to replace lost oil revenue?

Even a G7 country like Britain is likely to experience serious financial stress due to its oil and gas running out.

3) Why does the U.S. perform so abnormally well? I would attribute it to free enterprise and infrastructure -- lots of independent drillers, and lots of pipelines to make drilling for small pockets of oil economically viable. So the question is: Can (or will) the Russians and the Saudis do that? The Saudis are worrisome because they run their entire operation in a top-down fashion. Is it really possible for one organization (with no competitors) to drill as many wells, and install as much pipeline, as they are going to need?

-- by JD

11 Comments:

Ah Sharjah is a part of the UAE. Thanks for clearing that up.

The reason the US declines so slowly is because Alaska and the gulf of Mexico came online after the peak in 1970. This gives the false impression that US decline rates are less severe than is actually the case.

To get a more accurate picture of decline rates you need to look at individual oil producing regions rather than countries. Try adding the numbers of Norway, UK and Denmark, and dividing the US into Alaska, Texas and offshore.

anonymous, i'm sort of in agreement with you re: why political boundaries instead of geological regions...

but i don't see why alaska and gulf of mexico coming online after the 48 state peak give a false impression. isn't the point of depletion studies depletion over all fields, old, and those in the pipeline (pun unintended)?

in the u.s. new fields came online. i.e. new discoveries.

what would be interesting to see is what sorts of technology and field management the various regions use.

i'm sure there are some ruined fields out there where better management could have extended their life and prevented drastic declines.

i have to say tho, it doesn't look good for a manageable 2% decline.

woops, that was supposed to be 5%, not 2%.

Popmonkey, it's always been my impression that a 2%-3% decline would be possible because of the "higher hanging fruit" being accessed, not to mention once global decline hits areas previously off limits will quickly become within limits, there is easily a few MBPD offline because of politics right now.

This doesn't even take alternatives into account, I think factoring everything in first world countries can manage a 1% or so decline.

sorry what I meant to say was, that while first world countries' inputs might go down significantly more than 1%, mitigation and alternatives can probably reduce the effective loss of inputs considerably.

Lots of "middle class" countries are really going to get screwed though

Dear JD,

I think I owe you a personal thank you.

Though I agree with many others that the title you have chosen for your site is somewhat unfortunate I must congratulate you on compiling a great selection of information and presenting it in an organised manner.

This site has been a life saver. I've read several reactions that are very similar to my own, but I'll give you a little background on my confrontation with the PO phenomena anyway. Perhaps it is instructive to other readers as well.

I think I should begin by stating that I consider myself somewhat of a critical thinker. I am far from fuzzy, hate illogical thinking, detest new age, wouldn't buy a Homeopathic cure at gunpoint and visit James Randi's site every week.

So, when I stumbled across PO, and subsequently the die-off theory I wanted to test if there was any merit to it. I had always had a nagging worry about fossil fuel depletion and many of the implications had occurred to me before. However: die-off was new to me.

Since I'm not educated in any of the related fields, I did the next best thing I could think of: I searched the net for sites logically attacking PO and Die-off.

Although I came upon some articles attacking PO theory, these seemed to be poorly reasoned and aimed at blaming "Liberals" and "Eco-terrorists" for propagating the very "un-American" idea that finite resources can run out. My conclusion: the opponents of PO theory are a bunch of idiots and right-winged pundits with an agenda.

After working my way though *LOTS* of information about depletion (including the very credible Matt Simmons) I concluded that PO was real. This was very much supported by a barrage of corroborative data that I got mostly from energybulletin.net which I checked obsessively every day.

Next mission: cross checking the Die-off theory. Again: demographics, evolutionary biology and such are a mystery to me so my first action is looking for sites providing an opposing view.

I found none.

Depression set in. My wife was pregnant with our first child. I had always had a "devil may care" kind of attitude but with a child on the way this was a luxury I could not afford. I grew very silent for a few months brooding about how to deal with the coming economic downturn, collapsing food distribution, food riots, ethnic division igniting etc.

Then I decided that I would take action to protect me and mine. I did not believe in any particular scenario unfolding but I live in a densely populated area so I could envision a number of problems.

Get wood burner in working order. Buy books on survival. Apply for gun permit and get practice. Check how much space needed to store 40 days of food (a *LOT* of friggin space it turns out). Have look at the garden with a green-thumbed friend to see if I can grow food there.

OK, I admit I feel stupid about that episode in my life. But at the time it made me feel empowered. F*ck it! People lived through the black plague and the siege of Leningrad. I'm going to have my shot at getting through this! My grandfather survived a concentration camp! I have the survivor gene!

You get the picture. Laugh at me if you must. But this was my reality and I think I was responding adequately to a perceived threat.

And then I came across your site. At first I was angry: Peak Oil Debunked! How dare he! (I had typed those exact words into Google when looking for information initially and had come up snake eyes)

I was ready for the next God-boggled Bush supporter giving an opinionated diatribe. Needless to say I was pleasantly surprised.

So what is the sum total of this experience:

My wood burner works again.

I took up target shooting again and it is fun.

I know a lot more about gardening and growing food.

I spent a lot of time not being able to concentrate on my job.

I spend about four months hovering on the verge of depression.

I invested in an energy fund and an alternative energy fund and made a killing. (I'll hold on to those)

I invested in gold and made a killing (I'm holding on to those too)

What have I learned?:

My thinking is not as critical as I'd like to think. In fact I'm quite shocked at me buying into the doomer argument.

Considering the "reality" I was facing I held together quite well.

Internet has it's limits as a research tool. That also goes for Wikipedia. (Case in point: check out the entry about the Kennedy assassination which has been completely taken over by conspiracy nuts)

Don't be lazy! Reading the Hirsch report was much more instructive than reading "experts’ “interpretations of it.

Once again thank you for providing so much excellent information about new developments that can save mankind from it's oil addiction.

I no longer see PO as the end of the industrial age (though still a real danger on numerous fronts) but rather as the next chapter.

I'm currently studying the decline rate in more detail. The UK North Sea been worked out (205 fields one by one), and it isn't looking good as I already expected. Production will level off though for next 2 years in UK probably (Buzzard and some other fields coming on-stream and some older fields ending their lives thus no more decline). After those 2 years, cliff starts again...

The general decline trend observed is scary. Results will be published in a while probably.

I think a 3% to 3.5% assessment is more likely at the moment for the world. Haven't done the math yet.

Several comments are in order here.

1. Prudhoe Bay is the source of the 1980-1985 anomaly for the US. If you review worldwide discovery curves, the odds of finding more Prudhoe Bays appear to become lower and lower with each passing day. In turn, Prudhoe Bay distorts the rest of the US decline rate.

2. Even with #1 above, the US decline rate is better than the rest of the world for precisely the reason JD mentions at the end of his article - independent drillers who specialize in cleaning out old fields that big companies see as no longer profitable enough. While this worked for the US, I doubt it will work for the rest of the world. (See next two comments.)

3. Saudi Arabia is problematic and I can see no realistic way for Saudi Arabia to be scavenged in the same fashion as North America without imposing a huge military infrastructure. The existing Saudi royals apppear to have zero interest in pursuing such activities and regime change there would yield a violent, anti-western, Islamic state. The combined forces of Europe and the US could probably control it, but at what cost?

4. JD, have you been following Putin's consolidation of Russian oil production? The future in Russia looks bad, just as in Saudi Arabia, not because of lack of downslope oil (which should exist just as in the US) but because of politics. While the west could conceivably control Saudi Arabia at some high cost, I don't think Putin or his successors will allow the west to walk all over Russia. Plus they remain a major strategic nuclear power with a large strategic missile force.

5. More and more of our oil production is coming from offshore wells. Offshore is expensive to operate so such wells are deliberately operated in such a manner as to maximize output in order to be done with the well as soon as possible. These wells are going to see extraordinary decline rates plus they are scavenged by the majors before being shut back in and thus are not economical at all to reopen. It might be wise for everyone concerned to separate decline rates by onshore and offshore categories since the operational characteristics of offshore wells differ from onshore wells.

Roland, I have not gathered enough data yet to get a clear indication of post peak decline rates. I think it will be quite high. To my opinion OPEC will not peak quite soon but Non-OPEC will (probably around 2008). OPEC may be able to delay the worldwide peak but needs to increase it's production significantly to do this given high decline rates. Therefore i expect a delay for only a few years. And given the political and economical situation (mainly Iran and Iraq), even this may prove to be too optimistic.

On general, I think we may see 3% decline rates in the beginning (first 3 years?) increasing to 6% per year quite soon depending for instance on Russian decline (could be huge given their production tactics) and discoveries/technology. What we see in the UK is that decline does increase over time. decline type II + III has already hovered between 7% and 15% on average since 1991. Since 1997 it has stayed between 15% and 20%. I expect a drop next year though as many old fields finally run dry and some new (Buzzard) are started up.

Unfortunately, I do not have enough insights yet to ascertain any real certainties. Im guessing in the dark as so many are, but im working on gathering more data. When I have something, it will be made publicly available.

I also feel that the main problem is not actually oil reserves or technical production possibilities itself, but rather political (OPEC), economical (Russian taxes on every barrel of oil making investments not worthwile for oil companies), and practical reasons (shortage of rigs/workers).

This may cause a huge increase in decline rates.

Type V decline is by far the worst kind. That is when the oil in all the known solar systems in the universe dries out. Then that snappy crew from Star Trek can't just shop around for the best prices and have to resort to beaming up their horsees and wagons to get around.

Post a Comment

<< Home