266. MORE FUN WITH FOOD AND OIL PRICES

As expected, the myth that "higher oil prices will drive food prices through the roof " dies hard. The peak oilers simply can't handle the inconvenient truth that oil prices have very little impact on food prices.

Nevertheless, I'm a cheerful vampire slayer, so let's take another crack at it, and see if we can't drive a few more stakes into the heart of this myth.

A critic in the comments to the previous article (#265) writes:

Rising oil prices have not been reflected in a correspondent rise in corn prices (to use one of JD's examples) due largely to US government farm subsidies, of which corn growers are amongst the highest recipients (1). These subsides help keep the "farm value" (i.e. price of corn at the farm gate) artificially low.Proceeding to the critic's source, however, we find this incongruous information:

What drives the expenditures today is the same basic policy framework that has driven farm subsidy spending since the "world food crisis" of the early 1970s. When global grain and oilseed prices spiked dramatically, then-Secretary of Agriculture Earl Butz unleashed farmers from decades of production controls and exhorted them to plant "fence row to fence row" to meet the global demand for their crops—to feed the world. After forty years of "agricultural adjustment" programs, Butz foresaw that the government, at long last, was getting out of agriculture. Within a few years farmers were literally plowing up the Mall in Washington in protest of prices and incomes driven ruinously low by the pressure of massive crop surpluses.SourceIt appears our critic is a little confused about what agricultural subsidies actually do. If subsidies are provided to keep prices low, shouldn't prices rise -- not drop like a rock -- when they are eliminated?

Next, our critic notes that beef prices have risen somewhat with oil prices, and gives us the peak oiler rationale for this trend:

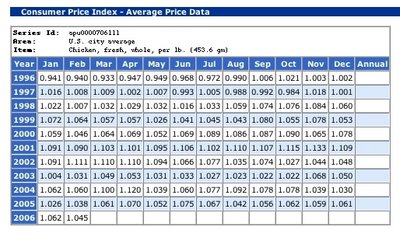

Getting the corn from the farm to the cow (or can) and ultimately into our mouths costs far more than just growing it. This farm-to-mouth process is the marketing cost and entails processing, packaging, transporting, and selling the corn (or corn-based product) at the supermarket. It is this cost that impacts price the most.So it would seem that all of this oil-fueled processing, packaging, transporting and selling is what has caused the price of beef to moderately rise. To verify this hypothesis, lets look at another type of meat: chicken. The following is a time series of prices for fresh whole chickens, per lb., from the Bureau of Labor Statistics (click to enlarge):

Now, from the EIA, we can obtain spot prices for Brent crude to give us a good solid run-up in oil prices:

Price of Brent in Dec. 1998: $10

Price of Brent in Feb. 2006: $60

That's an oil price increase of 6x, or 500%. So what did that do the price of chicken? Absolutely nothing, as you can see in the Table. In 12/98 chicken sold for $1.060/lb., and in 2/06 chicken sold for $1.045/lb. A 500% increase in oil prices led to a drop in chicken prices. So what happened with all the processing and transport etc.? Didn't they have to get the corn to the chickens' mouths, and get the chickens to the processing plant, and pluck the chickens, and wash the chickens, and package the chickens, and transport them to the supermarket etc. etc.? Looks like we have a serious glitch in the peak oil theory here.

The critic had yet another lame argument:

But this is not the point. Most of us don't drag our gunny sacks to the farm gate and fill them with corn. We purchase and consume corn in other ways, either fresh, frozen, or canned, or most often in the form of beef.Yes that may be true, but (as a few people noted) when you start talking about beef and frozen entrees etc., you're basically unmasking peak oil as a trivial lifestyle issue, not a life-threatening crisis.

Furthermore, aren't the peak oilers trying to get off the food grid because food prices are going to be astronomical after peak oil? To do that, I'm assuming they'll grow gardens. Hence they'll have to grow some staple grain if they really want to be self-sufficient. I haven't seen many peak oiler sites talking about how to do your own rice paddy, or wheat field, so probably the most straightforward "local" grain is corn. You know, plant a big plot Indian-style with corn hills, beans growing up the stalks, and intercropped pumpkins to keep the weeds down. Dry it all on the stalk, and harvest the kernels into paper bags by rubbing the cobs together. Mill with a hand mill and cook into corn bread or porridge etc. etc. It's a lot of fun, but what's the point of going to all that trouble to replace a food source (corn) whose price is demonstrably not affected by oil prices? It doesn't make sense, unless you're gardening just for relaxation, or as a hobby.

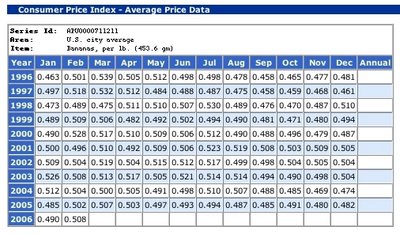

The peak oilers are also deeply concerned (elated?) about the impending death of the 3,000 mile salad. The theory is that high oil prices are going to drive the price of long-distance imports like bananas and coffee to astronomical levels, and they'll quickly disappear from store shelves. Lets do a reality check on that one with some more stats from the BLS (click to enlarge):

Isn't that wild? Oil prices rise 500% from $10 (12/98) to $60 (2/06), and banana prices drop from .510/lb. to .508/lb.

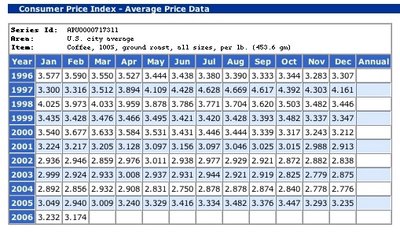

Here's the stats for coffee:

Just like bananas, a 500% rise in the price of oil results in an 8% drop in coffee prices.

Clearly the relationship of oil vs. food prices is way more complicated than the kindergartner economics of the peak oilers would suggest.

-- by JD

8 Comments:

Prices in general rose by 27% from 1996 to 2006 due to inflation. So real prices for most of the items on your list declined.

Oddly, two of the most "relocalized" items on the list -- milk and tomatoes -- exhibited high price increases.

If subsidies are provided to keep prices low, shouldn't prices rise -- not drop like a rock -- when they are eliminated?

1.) Subsidies are not provided to do anything on the consumer side. They are in place to keep a lobby happy.

2.) Subsidies are paid to grow and to not grow....

3.) Yes, economics is a bit more difficult than your kindergarden.

4.) I'll stick to my guns - it has to do PRIMARILY with availability, not price. You'll see. Just like a heart attack (or a blackout, for that matter) depends on either blood or no blood. Juice or no juice. In this debate, the question is: gradual weening away from oil (2% drop in production per year) or societal collapse, however it may look (jumps of 50% supply at a time). 2% change in supply of commodities is very uncommon. Just ask the North Sea.

Ja dig?

Well, Roland, it looks like we're getting to the heart of the discussion.

Let's just assume for a moment that world oil production were to fall at 4% per year beginning in 5 years, which is in my opinion a conservative estimate. Instead, I expect jumps of around 10% or even occasional increases, according to which countries are polically stable enough to export their oil at any given point in time. But nevertheless, back to 4% per year -

How much will this change in supply be in the USA? in Japan? in China? in Russia? in Europe? Hardly everywhere at 4% (!) at the same time. China might drop 50% in one year while the US gains 2%. Europe might drop the average 4% while the US loses 15% in one year. The East Coast may be well supplied but the West Coast has shortages. Or the coasts are well supplied while the blue states starve of energy.

That is what I mean with availability: One county (or region) may be standing in day-long lines waiting for gasoline to be delivered while another wonders where the problem is... Putin (or King Faud or whoever) decides that a tanker is not going out this week or month or year (or the natural gas is turned off) to your corner of the world. At the moment we have strategic reserves to combat the shortage, but let's not kid ourselves at how long they will last after this happens a time or two...

It will be like the Germans trying to win WWII at the end of the Battle of the Bulge. Fuel supply was EVERYTHING!!!

Think you'll even be able to get your hands on a burger if a shortage lasts a year or two? And what will your non-existent burger cost?

Ayah. Death to the McFarm, maybe. But the local farmer's markets here have been working in organics for the last twenty years.

And really. I wander down the street and count how many acres of viable farming land are being wasted by pristine, shit-and-oil-fed lawns on a single city block, and all it makes me realize is that even the suburbs could maintain themselves if micromanaged properly.

Is it likely? No. But the hard numbers of PO and JD's arguments drive home the fact that this one is humanity's to lose. Weathering the storm won't take a dose of new world McGuyverism, just some basic fucking know-how that even a five-year-old could implement.

Agriculture is a commodities market, meaning farmers have no control over the price of their product. Entirely market-set. We currently have an oversupply of food; food prices are going to remain low as long as the oversupply lasts.

Higher fossil-fuel-driven input costs (fuel, fertilizer, pesticides) will eventually drive farmers out of business, or lead them to attempt farming without conventional inputs. Either scenario will drop the supply of food. Only then - in the case of lowered supply - will food prices start rising.

The time lag between critical price increases and farmers going out of business or doing completely practice overhauls is going to be a number of years due to the financial structure of most farms. It's too soon to declare that oil price increases are not affecting food.

Agriculture is a commodities market, meaning farmers have no control over the price of their product. Entirely market-set. We currently have an oversupply of food; food prices are going to remain low as long as the oversupply lasts.

Higher fossil-fuel-driven input costs (fuel, fertilizer, pesticides) will eventually drive farmers out of business, or lead them to attempt farming without conventional inputs. Either scenario will drop the supply of food. Only then - in the case of lowered supply - will food prices start rising.

The time lag between critical price increases and farmers going out of business or doing completely practice overhauls is going to be a number of years due to the financial structure of most farms. It's too soon to declare that oil price increases are not affecting food.

Milk and meat both have gone up almost 100% since 1996 where I live and I can prove it. I collect newspapers and have copies from years back as well a some of my old grocery receipts. When the government talks about prices close your ears. It's the typical BS they always spew to keep the cost of living artificially low.

"As expected, the myth that "higher oil prices will drive food prices through the roof " dies hard. The peak oilers simply can't handle the inconvenient truth that oil prices have very little impact on food prices."

Well, well. Oil doubles. Food doubles. Feeling like a dumbass yet?

I note that you took down your tongue-in-cheek "peak oil starvation experiment" post. I guess even you are aware that actual food riots aren't very funny.

Post a Comment

<< Home