261. "MITIGATION" AND GAS TAXES

The peak oilers make a big deal out of the Hirsch report. In particular, they like to quote this sentence from the executive summary (p. 4):

The peaking of world oil production presents the U.S. and the world with an unprecedented risk management problem. As peaking is approached, liquid fuel prices and price volatility will increase dramatically, and, without timely mitigation, the economic, social, and political costs will be unprecedented. Viable mitigation options exist on both the supply and demand sides, but to have substantial impact, they must be initiated more than a decade in advance of peaking.This is their justification for believing that it's too late to avoid disaster. Here's a classic statement from Monte Myers, Den Mother of the doom troop over at peakoil.com:

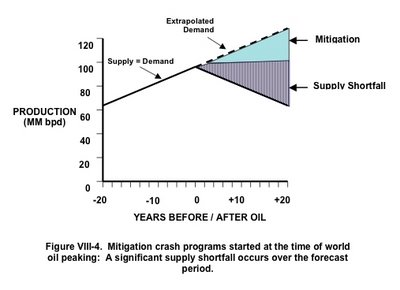

One of the things that has continuously puzzled me is that amongst the optimistic solutions posited to solve hydrocarbon depletion, I see an assumption that we have, or will have, the time to mitigate the consequences of peak oil. Mitigation, of any sort, will take time and a lot of money. And it will have to be applied world-wide, not just in the first world.This is a load of baloney, and it all hinges on the word "mitigation". You see, what the Hirsch report means by "mitigation", is an all-out crash program for producing more liquid fuels, as you can see from the following diagram (p. 57):

The Hirsch Report details that we need a 10-20 year crash mitigation plan in place before the peak.

This program is a pro-Exxon, pro-GM, pro-pollution, anti-conservation, Dick Cheney inspired load of crap, and the authors of the report frankly admit it (p. 50):

B. Mitigation OptionsIf you read the report, you'll quickly see that option 1) (lame as it is) is still just lip service. The crash plan is all about pork for oil/coal/refining companies, so they can quickly ramp up liquids production from coal, gas, oil sands, heavy oil and EOR, which are projected to provide 95% of the mitigation. There isn't a word in the entire report about conservation.

Our focus is on large-scale, physical mitigation, as opposed to policy actions, e.g. tax credits, rationing, automobile speed restrictions, etc. We define physical mitigation as 1) implementation of technologies that can substantially reduce the consumption of liquid fuels (improved fuel efficiency) while still delivering comparable service and 2) the construction and operation of facilities that yield large quantities of liquid fuels.

The raw stupidity of this plan is evident in the fact that 30% of the mitigation wedge shown in the above diagram is projected to come from heavy oil in Venezuela, as we've seen earlier. The authors do not explain how the United States is going to operate on Venezuelan soil in implementing its crash program to save braindead American motoring.

Still, these facts do not pose a serious problem, even if peak oil is imminent.

This is because it doesn't take decades to mitigate. It takes about 5 minutes -- time enough for the President to sign off on a big fat gas tax. Bing. You kill 4 birds with one stone:

1) Reduce demand for oil

2) Drive demand for alternatives

3) Generate massive revenues for building rail etc.

4) Kick Iran, Venezuela and the rest of OPEC in the nuts, and watch them squirm as oil prices and their government revenues drop like a rock.

Now, of course the doomers are in bed with Dick Cheney, and think that the American way of life is non-negotiable. There is no way in hell that the U.S. will ever pass a gas tax. It turns out this is wrong too. A majority of Americans actually favor a gas tax, provided you spin and package in the right way:

If you ask people straight out, "do you favor a gas tax," the answers is overwhelmingly (85%) No. Even if you promise to reduce other taxes --payroll and income -- by the same amount, the answer is still (63%) No.It is imperative to not let status quo mouthpieces like Hirsch et al., abuse the word "mitigation". Peak oil is -- by definition -- not a problem which can be solved on the supply side.

But if the question is, "would you support a gas tax if it reduced U.S. dependence on foreign oil" or "would you support a gas tax if it cut down on energy consumption and reduced global warming," the results reverse pretty dramatically. The "foreign oil" question gets 55% in favor and the "energy consumption and global warming" question gets 59% in favorSource

-- by JD

9 Comments:

A gas tax sufficiently beefy to bring prices at the pump in the USA in line with those in Europe would be a big cup of hemlock for any politician who supported it. Knowing it is a good idea is one thing. Thinking it will ever happen is another. Let's leave flights of fantasy to the doomers.

John Whitehead says:

"My current rule of thumb is that the short run elasticity of demand is about .1 and the long run elasticity is about .5. This means a 50% increase in gas prices leads to a 5% decrease in consumption in the short run and a 25% decrease in consumption in the long run."

(I am not endorsing this, its just the only numbers I have seen)

If we institute a $2.50/gal gas tax, we should get an immediate 10% drop in consumption and a 50% long term decrease. That would solve our import and peak oil problems, let's do it.

As for the politics, let's start to call for it here and now. Eventually politicians will begin to think it is a good idea.

Let's leave flights of fantasy to the doomers.

Paul, I would agree with you, but for one thing: auto dependence has profound, long-term national security implications for the United States.

National security is an issue which politicians take very seriously, and they'll ram it down the voters' throats if they have to. In fact, it would be great if both parties sat down and hammered out an agreement to jointly support gas taxes in the name of national security. Then they can handle it just like income taxes. Why don't we vote out the bastards who support income taxes? Because every candidate, in every election, supports income taxes. That's where gas taxes need to go.

khebab and westexas at graphoilogy recently posted a nice gas tax proposal. It's located here.

you can't ask someone to pay 70% of their income to get back and forth to their general labor job. and the fat cats that control everything here have no intrest in making that situation better.

There are so many options for getting to work, that this objection doesn't hold water. Anyone can easily reduce their commuting costs by moving closer to work, riding a scooter, car-pooling, bicycling, trading in for a car with better mileage, taking the bus, sleeping in a flop-house near work, telecommuting etc. etc. You don't need to turn to the fat cats to get the job done. You can do it yourself.

freak, if you think $5 gas will cause a disaster, then you think peak oil will be a disaster. That's the doomer argument, in a nutshell.

Personally, I don't make predictions, and I'm not counting on anything. I'm a hedger. The future can turn out lots of ways, and $5 gas is certainly one of those ways. In fact, if Al Qaeda got lucky tomorrow and took out a substantial chunk of Saudi production, $5 gas would be a bargain. That's an unlikely scenario, but it's possible and should be faced squarely.

Even if gas goes to $5 or $10, we still don't face doom because WE DON'T NEED PRIVATE AUTOMOBILES TO FUNCTION.

Speaking of making people drink the hemlock... here's an interesting card of candidates:

Candidate A: pro choice, pro gay marriage, anti gas tax

Candidate B: pro life, anti gay marriage, pro gas tax

Or, alternatively:

Candidate A: pro choice, pro gay marriage, pro gas tax

Candidate B: pro life, anti gay marriage, anti gas tax

Doomers treat Hirsch like Moses. Behold, the Prophet hath spoken. But Hirsch takes the most intensive sector of oil use, in the most intensive country in the world, and not only tries to mitigate decline in supply but also increased future demand. Pretty much a worst case scenario, and a strawman. (But don't say that at peakoil.com, you will likely get banned).

As for a gas tax, I would say don't do what we did in the UK. Effectively, the addiction of the consumer is transferred to the government. Our government spends the proceeds on health and welfare. Because the oil industry generates so much tax revenue, oil is supported, and renewables (which don't generate so much tax) are only supported in a token way. This is the reverse of what we wanted! Not only do we now have an expensive health/welfare system, but have little in the way of renewables.

I don't like to speak for the US, but I would have less confidence that in the US increased taxes go to the right place instead of to pork barrel projects than I do here.

So if you institute a gas tax, make damn sure the revenues go to the right place.

The only problem with this scheme is it would make government revenue as dependent on the National Traffic Jam as the auto makers and sprawl developers. In such a system, not only would our government be responsible as they are for enforcing sprawl-only urban planning policies, our government would be as addicted to over consumption of oil as the average crack-head is to crack.

dub_scratch, that's a really good point. Thanks for bringing it up. We've got to be very alert for such perverse incentives.

Any proposal also has to be really careful about creating loopholes for low income people, people living in the "country", people with handicaps etc. If you go that route, we're going to end up with a country full of fakers and frauds, still living in the exurbs and driving one to a car.

Even if oil prices rise steeply due to a supply/demand mismatch (rather than a tax), everybody is going to be demanding subsidies, loopholes, bailouts, assistance and other social compensation for their own personal losses. That's where the real peak oil battle is going to have to be fought.

High gas taxes are a bad, bad, bad idea. Once the money starts rolling in, government will find a way to spend it, making the state dependent on that revenue. The situation is not unlike that in France, where they fund health care partially on the back of cigarette taxes. That is, high gasoline taxes create perverse incentives on the part of the state. And don't get all "we'll refund part of it back to the payers" on me. How much do you pay in income tax? How big are your refunds? The prosecution rests.

Post a Comment

<< Home