226. THE SUPPOSEDLY "DISCREDITED" USGS

Peak oilers often dismiss the USGS World Petroleum Assessment 2000 due to the "failure of its discovery forecast". peakearl from the Oil Drum says it well:

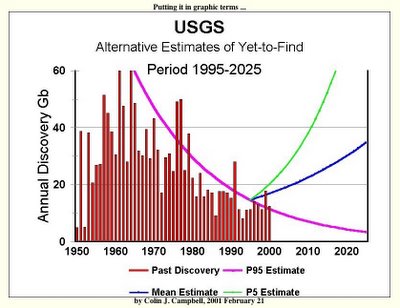

My understanding is the USGS report is based on a statistical procedure, not geology. The procedure would predict vast amounts of oil in many regions, and enough years have passed to see if their procedure had any validity. Predicted levels of discovery have not occurred at all, and I think have invalidated the analysis, which wasn't based on any known oil. Deffayes has commented that we are a full Middle East behind their predictions, and it's getting worse with time, as discoveries continue to shrink in number and size, with no sign of the trend reversing.This "discrediting" of the USGS stems from the following diagram, drawn by Colin Campbell (click to enlarge):

Allegedly, the USGS made the "predictions" indicated by the green, blue and purple lines, and the green and blue lines are totally out of step with actual past discoveries (indicated by the red bars). Therefore, the USGS has been totally discredited, and we don't have to pay attention to the USGS, or the sort of geological information which they analyze. There are a number of serious problems with this story.

1) The "forecasts" drawn by Colin Campbell are nowhere to be found in the USGS 2000 Assessment.

2) The USGS explicitly says that it is not making a forecast:

Note that the geology-based Seventh Approximation does not attempt to predict volumes of conventional resources that will actually be discovered in a given assessment time frame. To do so would require full knowledge of future petroleum economics, exploration technology, and exploration effort at the assessment-unit level. Rather, the Seventh Approximation estimates volumes of conventional resources having the potential to be discovered in the stated time frame.Source3) Colin Campbell frankly admits that he doesn't understand the methodology of the USGS report:

"Aaron asked:4) If wrong forecasts mean we should ignore somebody's data or methods, doesn't that mean we should ignore Colin Campbell, who has a long and embarassing string of past forecasting failures?

The methodology for estimating potential discoveries of oil is expressed by the USGS in F5, F50, & F95 probabilities. Given the decline in significant new discoveries of oil in recent history, is averaging F5 & F95 predictions still a valid approach for determining the mean estimate?

Dr. Colin J. Campbell:

I am not expert in Probability Theory. They plot amount up the Y axis and assessed probability along the X axis. The area under the curve is the Mean value. There are also Mode and Median values. The system probably has merit in assessing an individual prospect where there are actual parameters of thickness, porosity etc to compare, but I am sceptical when guessing the number and size of fields to be found, especially in little known areas. A better approach is to extrapolate past discovery trends."Source

-----

The USGS has not been discredited at all. The "failed forecasts of the USGS" are nothing more than a fraudulent straw man cooked up by Colin Campbell because THE USGS NEVER MADE A DISCOVERY FORECAST. Rather, they tried to estimate the amount of oil in the ground, which is subject to being discovered. They tried -- by exhaustively surveying the geological potential of every important sedimentary basin in the world -- to estimate the amount of undiscovered oil in the ground, regardless of political and economic factors.

The bottom line is this: The USGS World Petroleum Assessment 2000 is a gold mine of geological information, and it should be respected for what it is, not dismissed. Let's quit pretending that geological data is irrelevant to determining how much oil is in the ground. Discovery trends are one way of understanding future discovery potential. Looking closely at the geology is another way.

-- by JD

2 Comments:

Good point freak. The Campbell graph of discovery (the red bars) does not include the contribution from non-conventional oil. It doesn't include deep water oil, tar sands, or GTL, or coal liquefaction, or ethanol, or biodiesel etc., and that is a major error.

Chris, I assume you mean 1 trillion (for P95) and 2 trillion (for P50). With 2 trillion barrels left, that would put peak sometime before 2020, not 2030, since we'd only need to use up another half trillion to reach the halfway point. With increasing demand, that's probably around 2015, if we're lucky.

Post a Comment

<< Home