298. RESERVE GROWTH

There was a bit of confusion regarding the previous post (#297), so let me shed some light with a simple calculation.

Turning again to the BP Statistical Review, we obtain the following figures:

World oil reserves in 1980: 667Gb

World oil reserves in 2004: 1189Gb

Word oil production 1980-2004: 609Gb

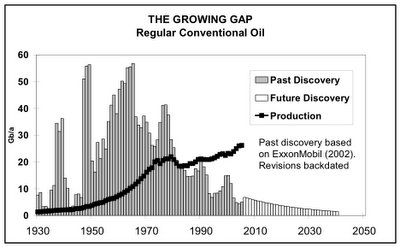

Now, I have also previously transcribed Colin Campbell's "Growing Gap" graph of discovery (Feb. 2006 version):

From this graph, we can derive total world discovery for the period 1980-2004:

World oil discovery 1980-2004: 339Gb

So let's do the calculation. We start in 1980 with 667Gb of reserves in the world. Over the course of 24 years (1980-2004), we pump out 609Gb of that, leaving us with 58Gb. To that we add the amount discovered in the period 1980-2004 (i.e. 339Gb), giving us a total of 397Gb in 2004.

Clearly, something has gone seriously haywire because the actual reserves in 2004 are 1189Gb, i.e. 792Gb more than we should have if discovery is the only way to increase reserves. That's a massive discrepancy roughly equal to 4 Saudi Arabias, or 66 Prudhoe Bays. So, all you peak oil geniuses out there, where did it come from? It could not have come from discovery.

Spurious additions to OPEC reserves won't explain it. OPEC reserves only increased by 456Gb from 1980 to 2004, so that still leaves us with 336Gb unaccounted for. That's 28 Prudhoe Bays which somehow got added to world reserves between 1980-2004, without being discovered. Where did that 336Gb come from?

We saw this same phenomenon at work in 239. GHAWAR NOW EMPTY. We have already pumped more oil out of Ghawar than the 1975 estimate of Ghawar's ultimately recoverable reserves (URR), according to data from Matt Simmons himself. So how do you explain that? Did the reserves in Ghawar somehow grow without any new discovery taking place? It definitely seems that they did. But if the reserves of Ghawar can grow without new discovery, why can't other OPEC oil fields grow in the same way? Why is it so outrageous to think that OPEC reserves can grow given that we are forced by the facts (as given by Matt Simmons) to admit that the reserves in Ghawar have grown?

Now, it's true that OPEC updates its reserves figures in an unorthodox way, and the additions seem fishy on the face of it. Nevertheless, it is silly to think that OPEC reserves do not grow, even though non-OPEC reserves world-wide do so. If OPEC reserves do not grow, then the reserves of Ghawar have not grown since 1975. Ghawar is now completely pumped out, as I have previously shown, and we are all already dead from the cataclysmic repercussions of that event.

-- by JD

6 Comments:

I just want to say that I just happened to find this site today and I am glad I did. I've been reading the posts and there are a lot that talk about terrorists and how things have changed.

I want to come out and formally say that of there is any reasonable person that think that just because 9-11 happened and now "everything has changed" than they're crazy. Why? Because if there is anything who thinks that terrorism is more dangerous than the 40 years we spent on the brink of nuclear disaster with the USSR then you've drunk the juice.

stephen, the whole point of this post is that factors other than discovery increase reserves. Pull your head out and answer the question: Where did that 336Gb (24 Prudhoe Bays) discrepancy come from? Explain it to me. Did it just appear out of nowhere? Or do numbers make your poor wittle head hurt?

I'm new to this site, having come here after watching a vid by Mike Ruppert, and getting the hell scared outta me.

Some of his points just "sat wrong" with my brain, so I determined to get the "other side of the story" by continuing to explore.

I wound up on this site (and a few others), and now have a firmer understanding.

JD, great site, and kudos for all the tireless work! Really though, you coulda stopped at entry 69 (and the graph showing the infamous "green line," below which, no economic growth should have been possible, but which was, in fact, a period of rampant growth and expansion.

That's really the beginning and the end of the discussion, in my mind.

The hard core doomer crowd seems to have backed away from social collapse and die off, and we have data indicating that economic growth can (and has) occured during periods where global net oil production actually shrank....so where's the problem?

Yes, eventually we will reach a point where we've pumped out half of all the oil that used to be in the earth....and?

If the hard core doomers have backed away from the die-off theory (for the most part), and we can rule out social collapse, and we have data indicating that economic growth is possible even in the face of declining production, and we have new (and promising) technologies in various stages of development right now, then where, precisely, is the crisis?

I come to this discussion with an economic background, not a geologic one, and I can tell you with absolute certainty that as the cost of a barrel of oil becomes pricier, one of the functions that unwittingly serves is to make the hunt for alternatives more profitable and compelling.

Bring on $100 oil! It only means that we'll get sustainable technologies that much more quickly.

$0.02

-=Velociryx=-

Can you please clear up what you are talking about? P50 or proved?

The note in the data says:

"Proved reserves of oil - Generally taken to be those quantities that geological and engineering information indicates with reasonable certainty can be recovered in the future from known reservoirs under existing economic and operating conditions.

Source of data: The estimates in this table have been compiled using a combination of primary official sources, third party data from the OPEC Secretariat, World Oil, Oil & Gas Journal and an independent estimate of Russian reserves based on information in the public domain."

dc

We (petroleum geologists) can shoot and process the best 3d seismic in the world.

We can interpret the data and run the best basin models in the world.

We can have the best geochemical models for source rock maturation you wish.

But, if the area of the world we are exploring didn't "jive" with the right sea-level stand, flora, fauna, ocean temperature, sedimentation rate, tectonics, heat flow ... shall I go on?... we will find "diddly squat".

Geology is for the large part the study of the results of the actions of the laws of physics on the evolution of the Earth's crust (and mantle if you like that kind of thing). Whether those laws of physics were operating in the Callovian, Turonian, or even Eocene sometime, they were more or less the same and were and are, in fact, immutable.

Economists will never discover oil. Geologists do that. And if geologists tell economists there is not much more oil to discover, and they know to well within a factor of 2 how much was already discovered, the economists either listen and shut up, or leave the room.

JD-

Great site. I would posit that the increases in reserves are primarily due to technology increasing the percent of actual oil in the ground that is recoverable. 1970's reserve estimates were based on recovering a few percent of the actual oil in the ground. Newere slant drilling, bore reaming, multiple bore, and other technologies are increasing the recoverability percentage significantly.

Another factor impacting reserves is that easily recoverable fields are being replenished from below, as the abiotic oil crowd posits, though I don't really regard this oil as abiotic, since it is primarily created by tectonically subducted methane hydrates reacting in subduction zones and becoming oil, propane, natural gas, etc. By my calculations, several cubic kilometers of subducted methane hydrates are converted into oil and gas every year.

Post a Comment

<< Home